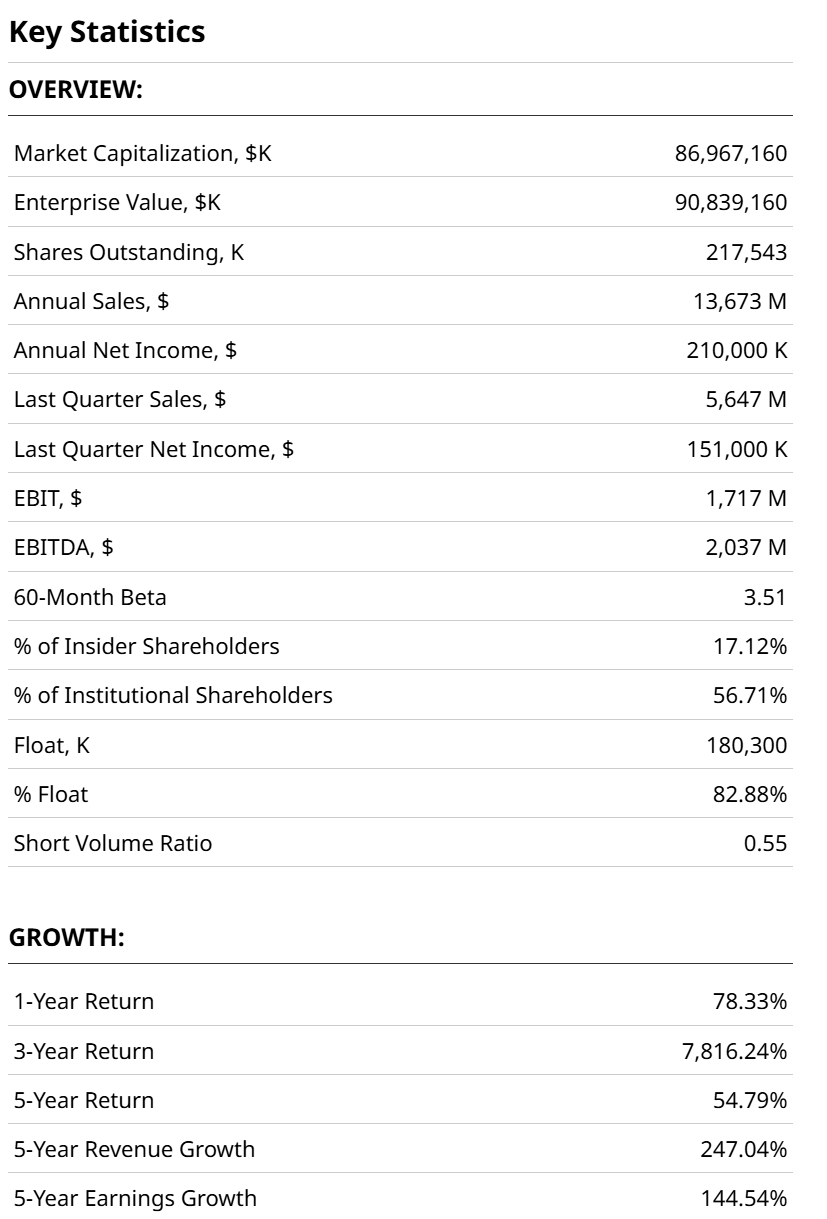

There’s nothing like being added to the S&P 500 Index ($SPX) to get a stock going, eh? Carvana (CVNA) had that honor bestowed on it Monday, as it was added by the S&P committee to its most iconic list of large-cap stocks.

But now that the news is out, and the stock has performed like, shall we say, a flying car, is this a sell-the-news situation, or just the start of something bigger for the Arizona-based company? If you are familiar with my work here, you probably know the answer is neither. When a stock is up like this one is, I look to collar it.

Now, I have not participated in CVNA’s remarkable 3-year return of… wait for it… 7,800%! It has made a round trip from about $375 a share, to near-zero, back to that previous peak and above. All in the past 50 months. An amazing story, but one that likely leaves the stock vulnerable to the common risk of high expectations.

Now an $87 billion market cap stock, its S&P 500 rookie year starts with it sporting a 3.5 beta for the past 5 years. In other words, it all worked out over time, but it has been one rough ride to get here. And with institutions owning more than 56% of shares, there’s a risk that some will blink at the first sign of trouble.

Collaring CVNA: Like Snow Tires for a Stock

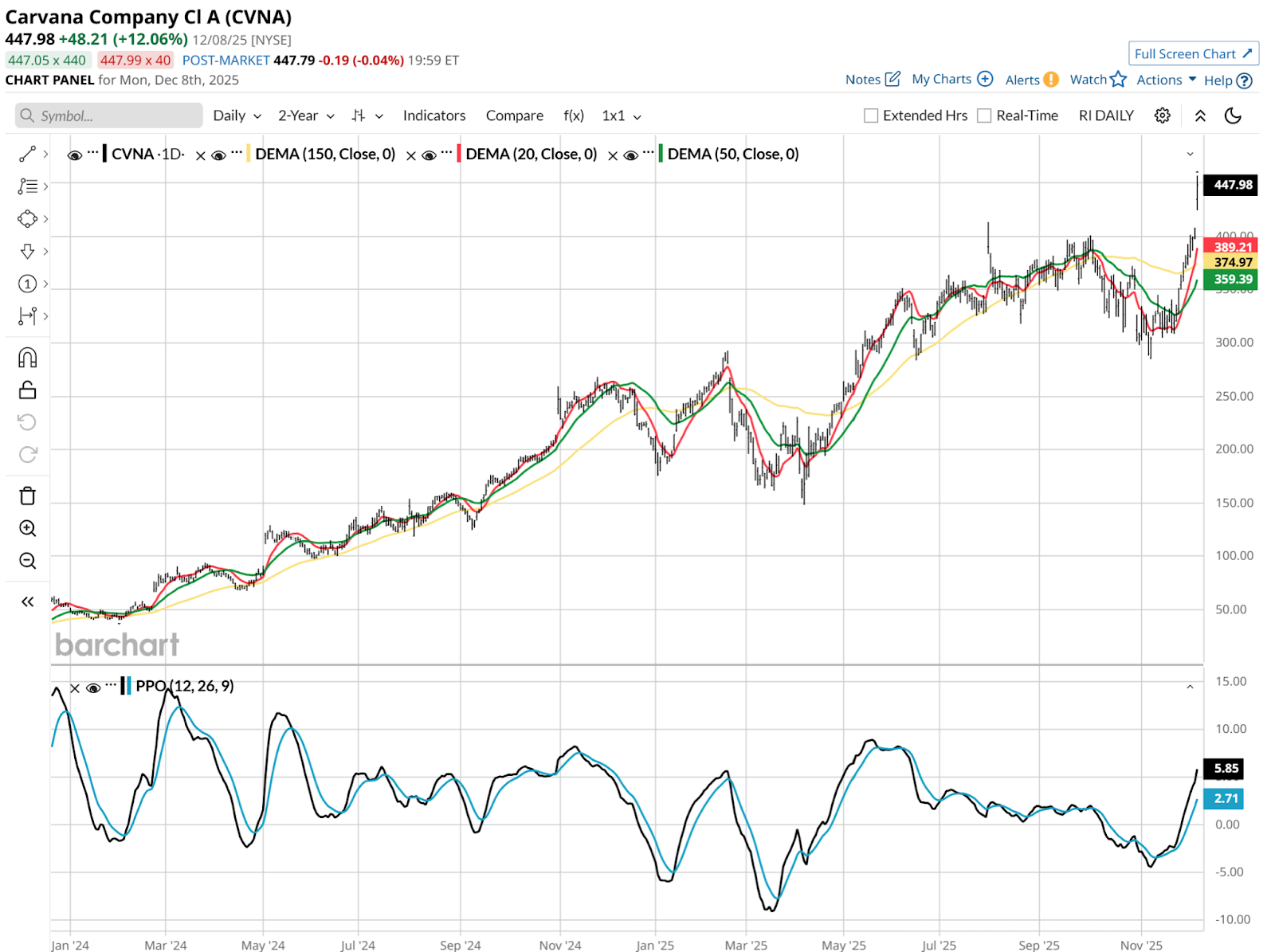

In order to collar this one effectively, we have to get a sense of where it has been. No skid marks needed as evidence here, just the usual daily and weekly price charts to get a sense of where those big institutions might be sensitive to CVNA’s price movement.

This is a nice, clean breakout, except for two things: the news will not be repeated. CVNA is in the S&P 500 now, case closed. And that allows it to get a piece of the “passive flow” from all the money indexed to the S&P 500, a massive sum nowadays. So there’s a natural bid under the stock that did not exist before this week.

Still, it is not even in the top 150 largest stocks in that giant index. So it won’t move the market often, it will just tag along when the S&P 500 rallies on continued massive inflows, should that continue as it has. The daily chart looks strong, but that news-driven factor is a caveat to me.

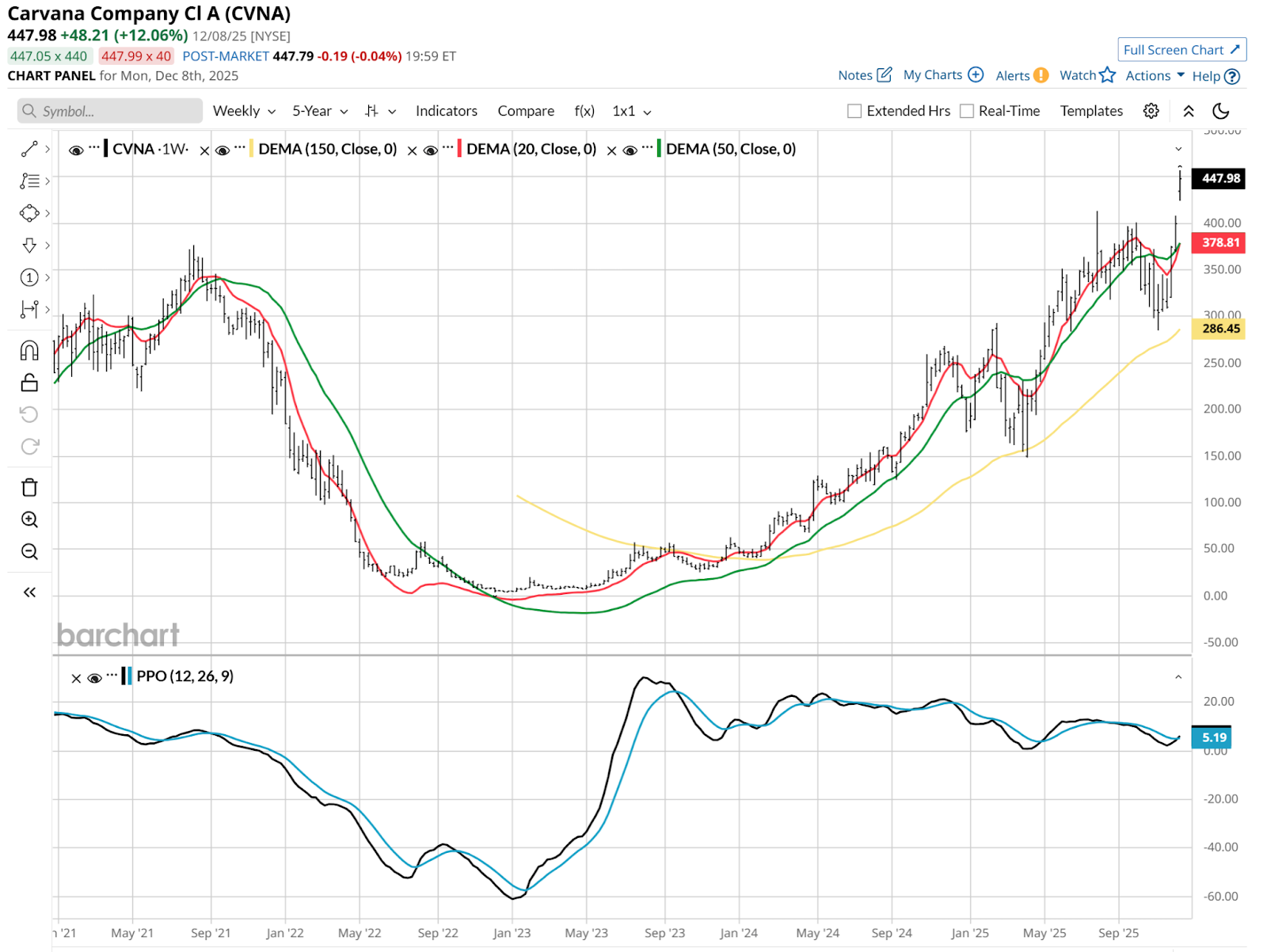

Above is the weekly chart, and this is more of a flattish appearance, looking at the Percentage Price Oscillator (PPO) indicator at the bottom section of the chart. The 20-week moving average just turned higher, but the same event-related concern exists there as with the daily.

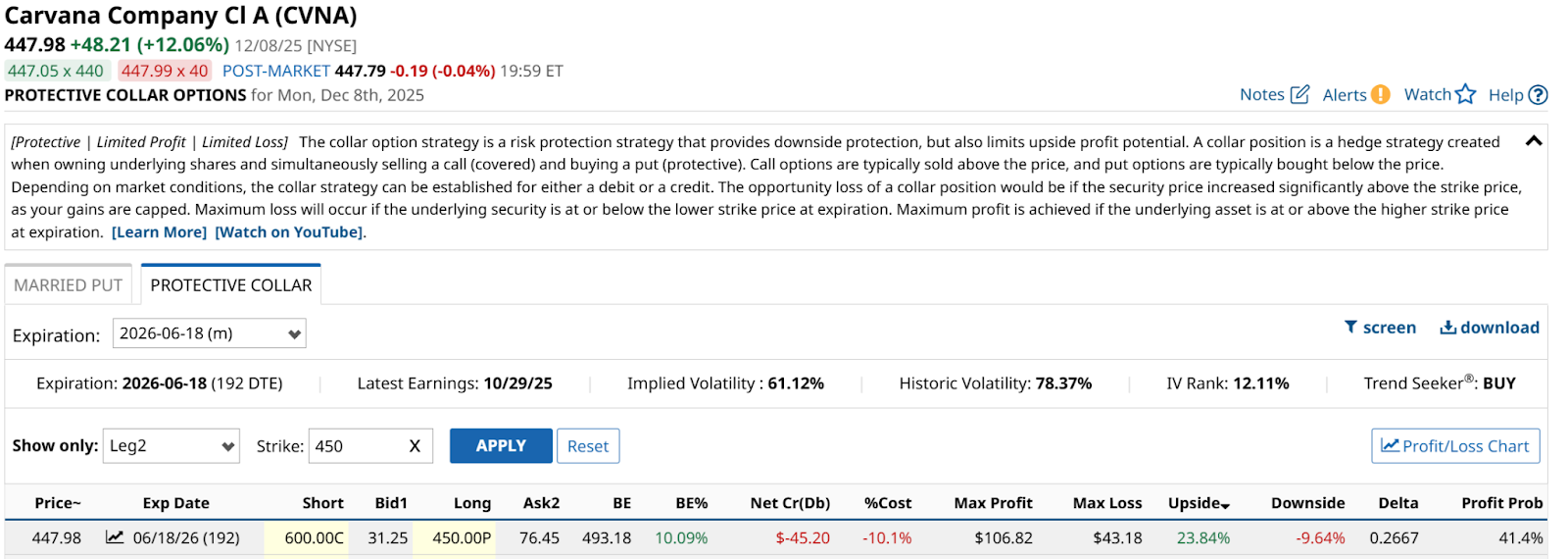

This leads me to the collar, as a way to protect gains for those fortunate enough to have them. And to do so while maintaining a good chunk of future upside. Volatile, recently appreciated stocks are ideal collar candidates.

Collaring CVNA

I went through my usual process, and started with a put strike around the current stock price. I went out about 6 months to June 2026. And with the put struck at $450, upside all the way to $600 during that time can be had for a tradeoff of 24% capped return, with downside risk limited to just under 10%. That’s also the out of pocket cost of the option pair.

This highlights one of the many tradeoffs collar traders need to account for. Look at that implied volatility. It’s 61%, nearly 4 times that of the S&P 500 Index that CVNA just joined. That said, CVNA is only in the 12% percentile of its 12-month volatility. Translation: You think this is high volatility for this stock? Well it is actually low in relative terms. That has an impact on the option pricing, in that it does not allow the call premium to be quite as high as it could be. That has a chain reaction that limits the up/down ratio somewhat.

But hey, who’s complaining if you have owned this stock over the past 3 years? The collar is never perfect, and they are all different. But at least the markets of today offer us a chance to take some of the risk out of investing in high-flying names like CVNA.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After a Red-Hot Rally on S&P 500 Inclusion, Carvana Stock Needs a ‘Cool’ Option Collar. How to Trade CVNA Here.

- Short vs. Long-Term Covered Calls on WFC: Which Works Better?

- A Major Shift in Adobe’s (ADBE) Risk Geometry Points to Fresh Upside

- Snowflake Stock is Down But Its FCF Margin Guidance Could Lead to a 22% Higher Price Target