DA Davidson recently issued a stock idea that was best positioned to survive an AI bubble-bursting scenario. It is a big name, and one many are already familiar with: Microsoft (MSFT). In case you didn’t know, Microsoft has a significant stake in OpenAI, the maker of ChatGPT. It is this stake that primarily drives analyst Gil Luria’s bullish take on the stock.

According to the analyst, Microsoft has a significant dependence on OpenAI. It derives 75% of its Azure AI revenue, 17% of total Azure revenue, and 6% of overall revenue from the ChatGPT maker. This means Microsoft’s future depends heavily on OpenAI and its success. Analysts factored in various scenarios for OpenAI and believe Microsoft is well-placed to benefit from OpenAI’s growth and improving valuation.

Luria also pointed out that OpenAI wasn’t the only reason to be bullish on the tech giant. She believes even within AI, MSFT is well-diversified with investments in Anthropic as well as its own internal models. These investments help the company mitigate some risks that investors often worry about. Regulatory and concentration risks will continue to haunt the company in the near term. The access to OpenAI’s models is a big advantage, but it could mean nothing if OpenAI were to lose its lead. Similarly, the company’s margins could get hit if the AI investments don’t turn out as forecasted. DA Davidson’s recent comments show how Wall Street is bullish on the stock despite all these risks.

About Microsoft Stock

Founded in 1975, Microsoft is a multinational technology company, famous for its Windows operating system. Over the years, it has also become a cloud computing and AI powerhouse, behind only Amazon when it comes to providing cloud services. It is headed by its CEO, Satya Nadella, and headquartered in Redmond, Washington.

MSFT’s stock performance has been relatively subdued over the past year despite its significant AI investments. The stock has returned 10% in a year, underperforming the S&P 500’s ($SPX) 13.23%. The company is the second largest in the index by weightage, behind only Nvidia (NVDA).

Microsoft’s initial $13.5 billion investment in OpenAI is now worth about 10 times as much. Due to the Windows maker’s accounting practices, this increase is still not factored into its balance sheet, even though it records the negative financial impact from OpenAI on its income statement. This has acted as a short-term headwind for the stock. However, a healthy stake, a long-term partnership, and OpenAI’s 75% market share of the AI chat market provide MSFT the right ingredients to be a top AI company over the next decade, making it a great investment even if the so-called AI bubble were to burst.

A look at Microsoft’s valuation metrics is also interesting in the context of an AI bubble. The stock’s forward P/E ratio of 30.73x sits below its 5-year average of 31.84x. This suggests the company’s valuation hasn’t run too far ahead. Notably, even the forward price/cash flow ratio of 21.17x is 12.77% below the five-year average. While people consume themselves with talk of an AI bubble, Microsoft is actually a strong case for an undervalued AI play!

Microsoft Beats Earnings Estimates

MSFT announced its Q1 2026 earnings on Oct. 29, posting a 13.15% earnings surprise. The EPS of $4.13 comfortably beat expectations of $3.65. As is usually the case, Cloud revenue was the major earnings driver, growing 26% YoY. CEO Satya Nadella pointed out how the increasing demand for Microsoft’s AI platform and copilots was prompting the company to continue investing heavily.

On OpenAI investments, the CEO was quick to refer to the $250 billion worth of Azure services already contracted by OpenAI, along with API exclusivity and IP rights. In 2026, the company plans to increase its AI capacity by over 80%. It could see its total data center capacity double within the next two years if AI investments go as planned.

What Analysts Are Saying About MSFT Stock

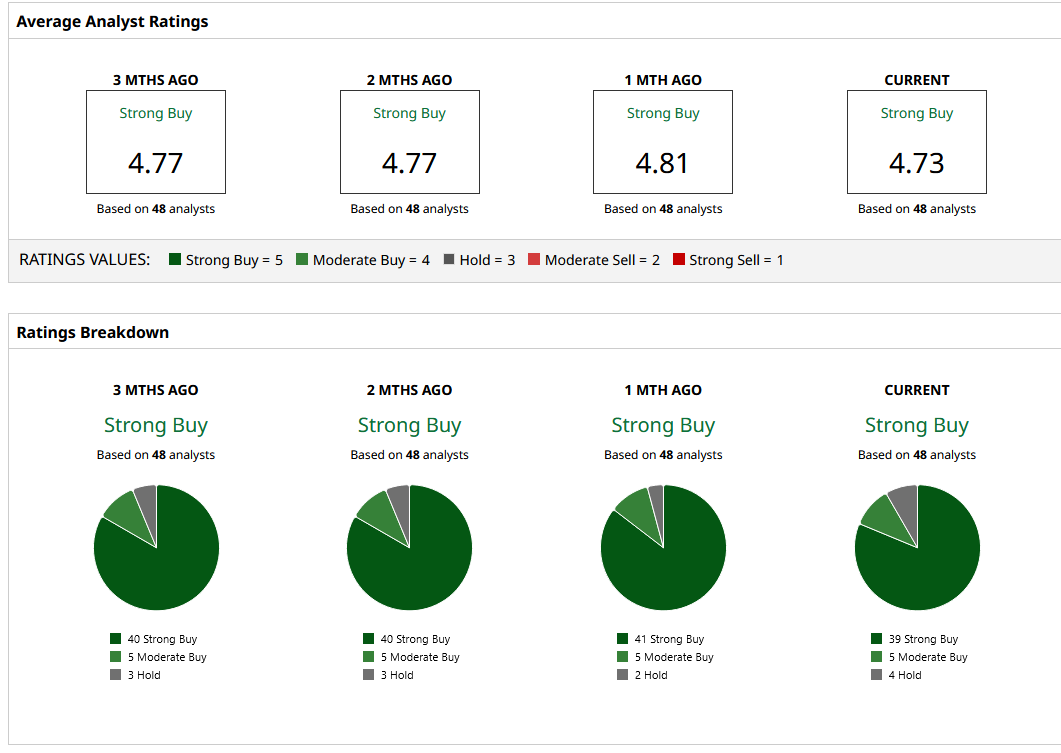

MSFT is covered by 48 analysts on Wall Street, with 39 of them supporting a “Strong Buy” stance, much like Gil Luria. She has assigned a price target of $650 to the stock. She believes Microsoft will be the biggest winner in AI, and the Wall Street consensus supports this opinion. The median price target of $630.59 offers 30% upside to investors, while the most bullish stance predicts the stock to reach $700, a further 45% gain from here on.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 8% in December, Investors Should Wait Until Late January to Buy Harley-Davidson

- Protect Your Babies and Your Portfolios with This ‘Strong Buy’ Stock

- Even If There Is an AI Bubble, Wall Street Says You Should Keep Buying This Magnificent 7 Stock

- Nvidia Just Gave Its CUDA Platform a Major Revamp. Will That Move the Needle for NVDA Stock?