WEC Energy Group, Inc. (WEC), headquartered in Milwaukee, Wisconsin, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services. Valued at $34.1 billion by market cap, the company’s infrastructure spans 35,500 miles of overhead and 36,500 miles of underground distribution lines, with extensive gas mains, transmission lines, and storage capacity.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and WEC perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the utilities - regulated electric industry. WEC’s strengths include its regulated utility operations, providing stability and predictable cash flows. Its Midwest presence offers operational efficiencies and mitigates risk. The company's strong balance sheet enables investments in infrastructure and innovation, including smart grid tech and renewables. Its focus on safety, reliability, and customer satisfaction drives operational excellence and positions it for long-term success.

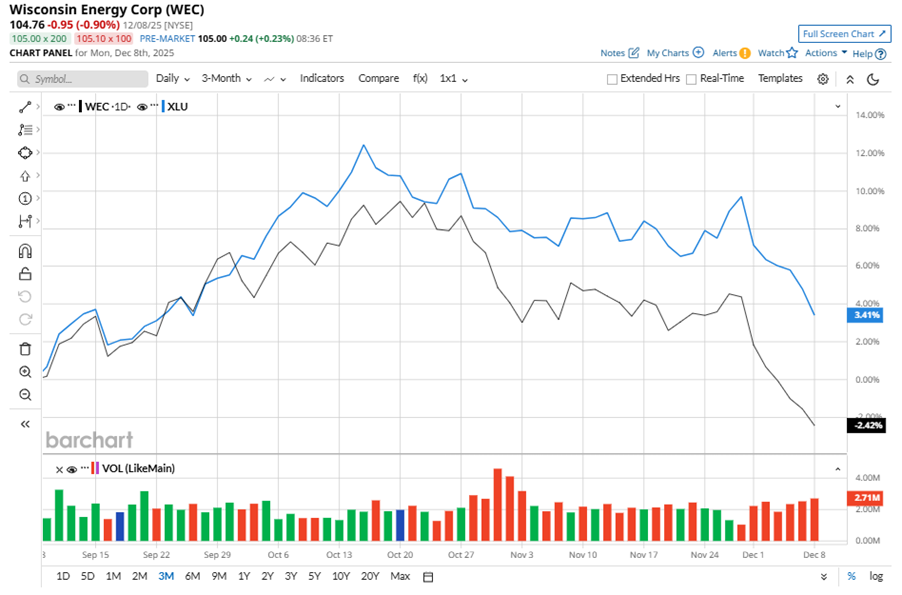

Despite its notable strength, WEC slipped 11.4% from its 52-week high of $118.19, achieved on Oct. 22. Over the past three months, WEC stock declined 2.4%, underperforming the Utilities Select Sector SPDR Fund’s (XLU) 3.4% gains during the same time frame.

In the longer term, shares of WEC fell marginally on a six-month basis, underperforming XLU’s six-month gains of 5.2%. However, the stock climbed 7.9% over the past 52 weeks, outperforming XLU’s 7.2% returns over the last year.

To confirm the bearish trend, WEC has been trading below its 50-day moving average since late October. The stock has been trading below its 200-day moving average recently.

WEC stock is rising on growth prospects, driven by rising energy demand, data center development, and infrastructure modernization.

On Oct. 30, WEC shares closed down more than 1% after reporting its Q3 results. Its EPS of $0.83 topped Wall Street expectations of $0.79. The company’s revenue was $2.1 billion, exceeding Wall Street's $2 billion forecast. WEC expects full-year EPS in the range of $5.17 to $5.27.

In the competitive arena of utilities - regulated electric, Xcel Energy Inc. (XEL) has taken the lead over WEC, showing resilience with a 10.5% uptick on a six-month basis and 8.6% gains over the past 52 weeks.

Wall Street analysts are reasonably bullish on WEC’s prospects. The stock has a consensus “Moderate Buy” rating from the 18 analysts covering it, and the mean price target of $123.47 suggests a potential upside of 17.9% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart