CBRE Group, Inc. (CBRE) is the world’s largest commercial real estate services and investment firm, headquartered in Dallas, Texas. Valued at a market cap of $47.9 billion, the company provides a full suite of services, including leasing and sales advisory, capital markets, property and facilities management, valuation, investment management, and project and workplace solutions.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and CBRE fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the real estate services industry. Operating in over 100 countries with more than 140,000 employees, the company provides services such as property and facilities management, leasing, sales, project management, capital markets advisory, and real-estate investment management. CBRE serves major corporate clients globally and is a Fortune 500 and S&P 500 company.

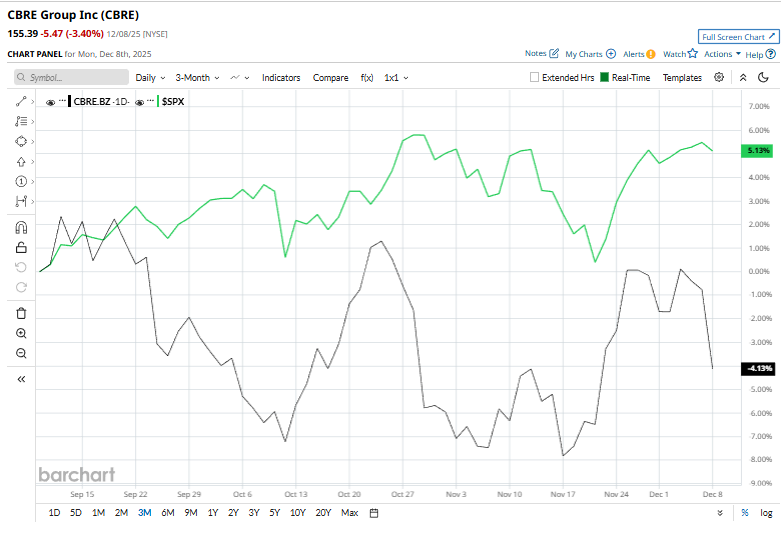

CBRE recently met its 52-week high of $171 on Oct. 23 and is currently trading 9.1% below that level. CBRE has dropped 5% over the past three months, lagging behind the S&P 500 Index ($SPX) 5.4% surge over the same time frame.

CBRE has rallied 12.7% over the past 52 weeks, slightly outperforming SPX’s 12.4% gain over the same period. Moreover, on a YTD basis, shares of CBRE are up 18.4%, surpassing SPX’s 16.4% return.

To confirm its bullish trend, CBRE has traded above its 200-day moving average since early June and recently crossed above its 50-day moving average.

On Oct. 23, shares of CBRE inched higher marginally after the company posted better-than-expected Q3 2025 results, delivering adjusted EPS of $1.61 and a 13.5% year-over-year revenue increase to $10.26 billion. The firm also raised its 2025 core EPS guidance to $6.25–$6.35, supported by strong leasing momentum and solid growth in facilities management amid a rebound in U.S. office activity.

CBRE has trailed its rival, Jones Lang LaSalle Incorporated’s (JLL) 15.4% increase over the past 52 weeks and 26.4% rise on a YTD basis.

The stock has a consensus rating of "Moderate Buy” from the 12 analysts covering it, and the mean price target of $185.36 suggests a 19.3% premium to its current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart