Atlanta, Georgia-based PulteGroup, Inc. (PHM) is one of the largest homebuilders in the U.S., designing and constructing single-family homes, townhomes, and condominiums across a wide range of price points. Valued at a market cap of $24.3 billion, the company operates through well-known brands including Pulte Homes, Centex, Del Webb, DiVosta, John Wieland Homes & Neighborhoods, and American West.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and PHM fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the residential construction industry. With a diversified geographic footprint and a consumer-targeted product mix, the company continues to benefit from favorable demographic trends and sustained demand for new construction homes in the U.S.

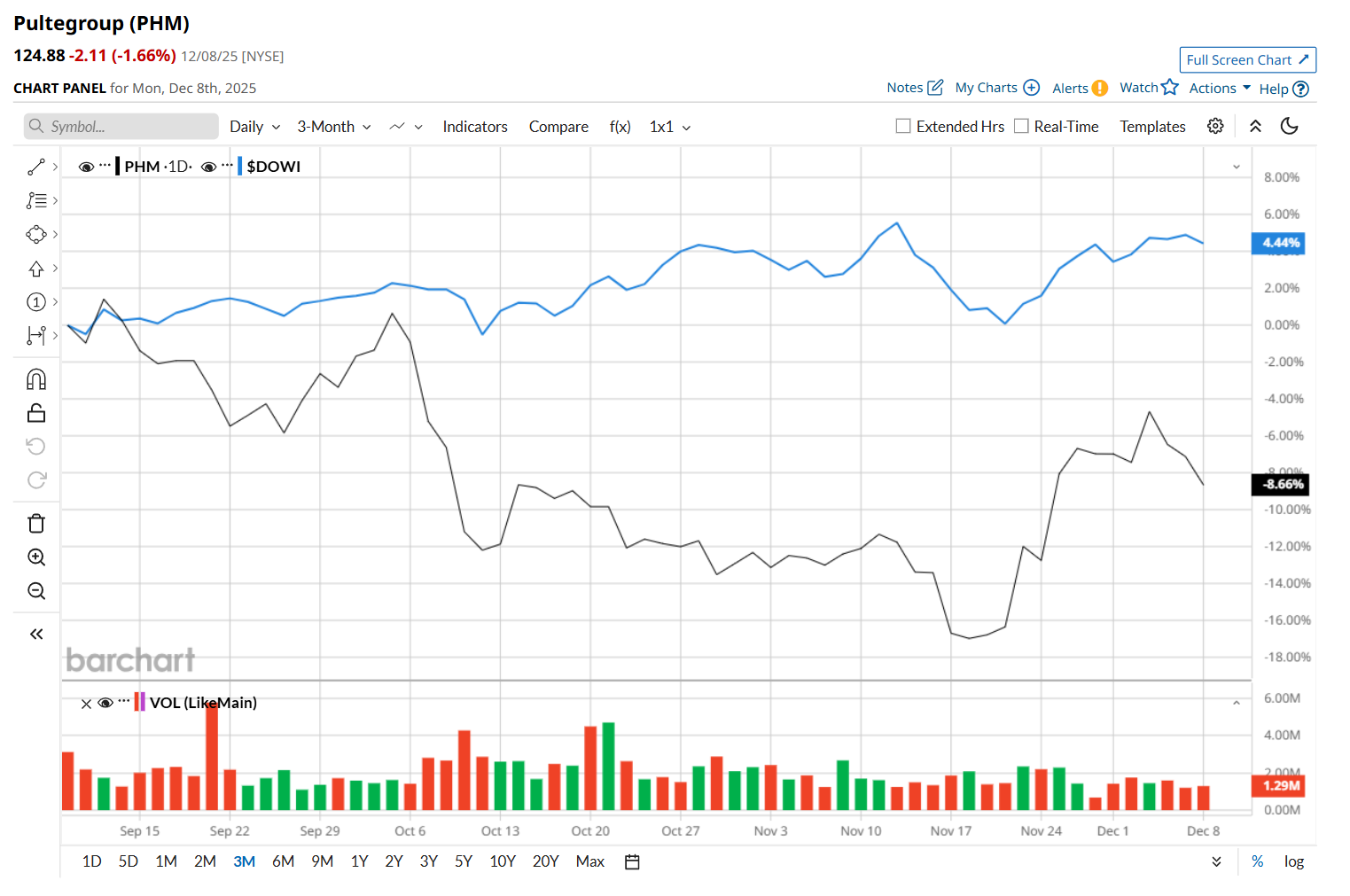

This homebuilder has slipped 12.1% below its 52-week high of $142.11, reached on Sep. 5. Shares of PHM have declined 11.7% over the past three months, underperforming the Dow Jones Industrial Average’s ($DOWI) 4.9% rise during the same time frame.

Moreover, in the longer term, PHM has fallen 1.5% over the past 52 weeks, lagging behind DOWI’s 6.9% uptick over the same time frame. However, on a YTD basis, shares of PHM are up 14.7%, outpacing DOWI’s 12.2% return.

To confirm its bullish trend, PHM has been trading above its 200-day moving average since late July, and has remained above its 50-day moving average since late November.

On Oct. 21, PHM delivered better-than-expected Q3 earnings results, and its shares remained unchanged after the release. While the company’s total revenue declined 1.6% year-over-year to $4.4 billion, it topped analyst expectations by 2.3%. Moreover, its EPS also fell 11.6% from the year-ago quarter to $2.96, but surpassed consensus estimates by 3.5%. Its net new orders dropped by 5.6% from the same period last year to 6,638 homes in the quarter.

PHM has outpaced its rival, D.R. Horton, Inc. (DHI), which declined 3.8% over the past 52 weeks and gained 9% on a YTD basis.

Despite PHM’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 17 analysts covering it, and the mean price target of $138 suggests a 10.5% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Even If There Is an AI Bubble, Wall Street Says You Should Keep Buying This Magnificent 7 Stock

- Nvidia Just Gave Its CUDA Platform a Major Revamp. Will That Move the Needle for NVDA Stock?

- Dear Carvana Stock Fans, Mark Your Calendars for December 22

- After a Red-Hot Rally on S&P 500 Inclusion, Carvana Stock Needs a ‘Cool’ Option Collar. How to Trade CVNA Here.