New York-based Take-Two Interactive Software, Inc. (TTWO) is a leading global video-game publisher and developer known for blockbuster franchises such as Grand Theft Auto, Red Dead Redemption, NBA 2K, Borderlands, and others. Valued at $45.6 billion by market cap, the company operates through key labels including Rockstar Games, 2K, and Zynga, covering console, PC, and mobile platforms.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and TTWO perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the electronic gaming & multimedia industry. With a worldwide presence and a strong portfolio of high-revenue titles, Take-Two is recognized as one of the most influential companies in the gaming industry, supported by a large and growing digital distribution business.

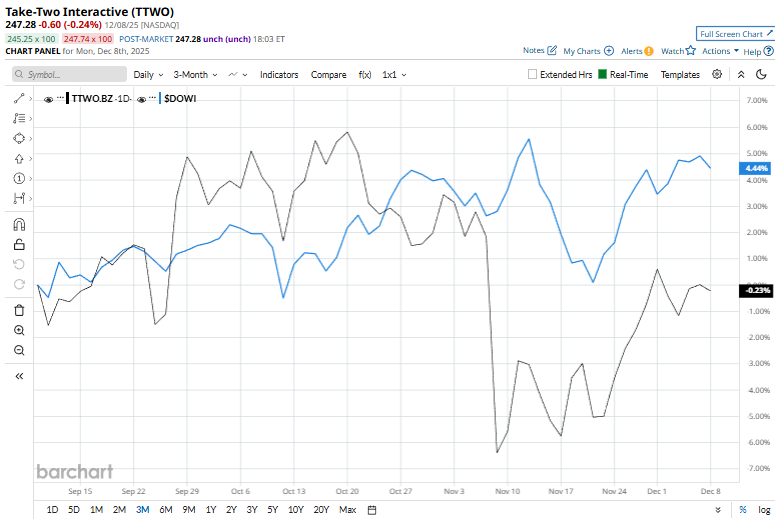

TTWO slipped 6.6% from its 52-week high of $264.79, achieved on Oct. 15. Over the past three months, TTWO stock has dipped marginally, underperforming the Dow Jones Industrial Average’s ($DOWI) 4.9% rise during the same time frame.

In the longer term, shares of TTWO rose 34.3% on a YTD basis and climbed 30.4% over the past 52 weeks, outperforming DOWI’s YTD gains of 12.2% and 6.9% returns over the last year.

While TTWO dipped below its 50-day moving average last month, it has been trading above its 200-day moving average for the past year.

On Nov. 6, Take-Two Interactive shares sank 8.1% after the release of its second-quarter earnings, as investors reacted sharply to news of a delay in the highly anticipated Grand Theft Auto VI. Despite the market’s disappointment, the company posted strong underlying results. Quarterly revenue jumped 31.1% year-over-year to $1.8 billion, significantly topping consensus estimates, while non-GAAP EBITDA reached a robust $116.7 million. Additionally, operating cash flow for the first half of 2026 improved markedly, swinging to $83.7 million from a negative $319.4 million in the prior-year period.

In the competitive arena of electronic gaming & multimedia, Electronic Arts Inc. (EA) has lagged behind TTWO over the past year with a 21.9% gain , but its 39.1% uptick on a YTD basis has surpassed TTWO.

Wall Street analysts are bullish on TTWO’s prospects. The stock has a consensus “Strong Buy” rating from the 27 analysts covering it, and the mean price target of $274.81 suggests a potential upside of 11.1% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart