Valued at a market cap of $511.9 billion, Oracle Corporation (ORCL) offers products and services that address enterprise information technology environments. The Austin, Texas-based company is scheduled to announce its fiscal Q3 earnings for 2026 in the near future.

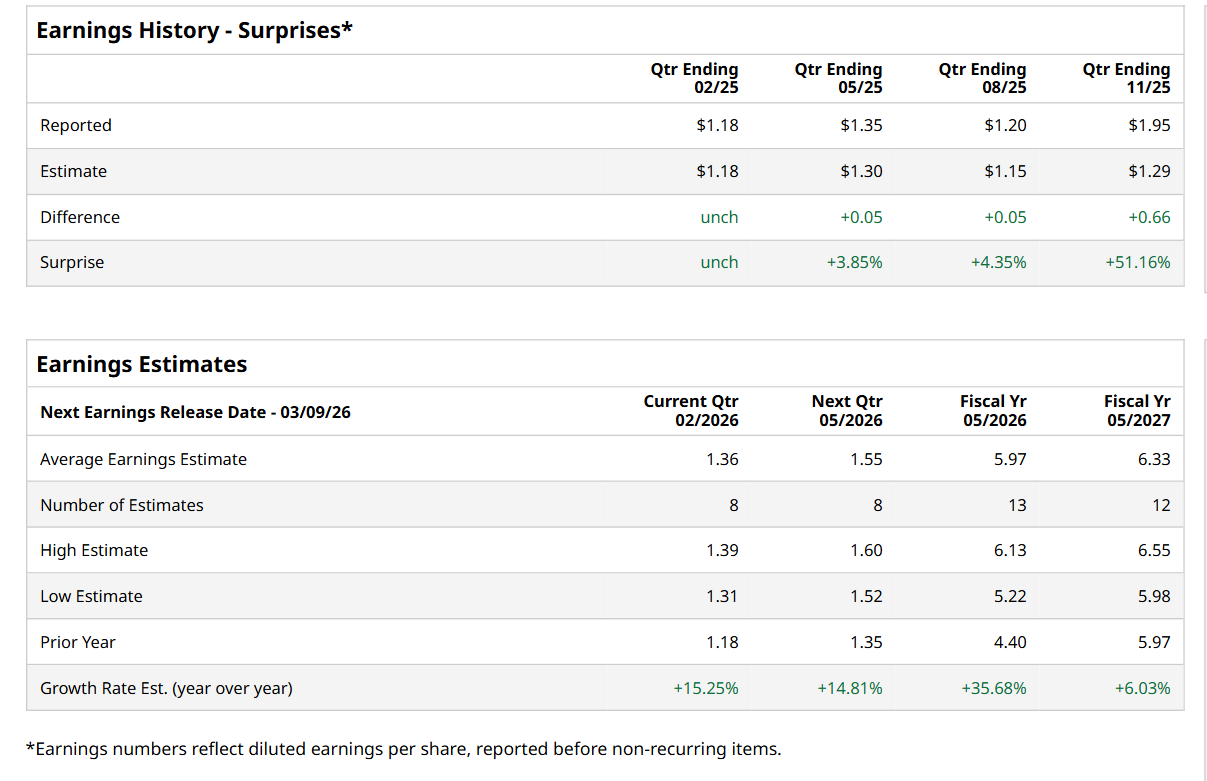

Ahead of this event, analysts expect this software company to report a profit of $1.36 per share, up 15.3% from $1.18 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in each of the last four quarters.

For the current fiscal year, ending in May, analysts expect ORCL to report a profit of $5.97 per share, up 35.7% from $4.40 per share in fiscal 2025. Furthermore, its EPS is expected to grow 6% year-over-year to $6.33 in fiscal 2027.

ORCL has declined 6.8% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 13.6% return and the State Street Technology Select Sector SPDR ETF’s (XLK) 19.3% uptick over the same time period.

On Dec. 10, ORCL delivered mixed Q2 earnings results, and its shares plunged 10.8% in the following trading session. The company’s revenue increased 14.2% year-over-year to $16.1 billion, but missed analyst estimates by a slight margin, which weighed on investor sentiment. Nonetheless, on the upside, its adjusted EPS grew by a notable 53.7% from the year-ago quarter to $2.26, topping consensus estimates. Moreover, its Remaining Performance Obligations (RPO) increased by about 15% sequentially to $523 billion, supported by new long-term commitments from customers such as Meta Platforms, Inc. (META), NVIDIA Corporation (NVDA), and others.

Wall Street analysts are moderately optimistic about ORCL’s stock, with an overall "Moderate Buy" rating. Among 41 analysts covering the stock, 29 recommend "Strong Buy," one indicates a "Moderate Buy,” 10 suggest "Hold,” and one advises a “Strong Sell.” The average price target for ORCL is $304.03, indicating a 71.3% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Tesla Ditches Safety Monitors in Austin, Should You Buy TSLA Stock for a Robotaxi Future?

- Dear Netflix Stock Fans, You Have 1 Month Until a Major Catalyst

- Ahead of the New TikTok USA Spinoff, Should You Buy Oracle Stock?

- Raymond James Loves AI Overviews. Why That Makes Google Stock a Strong Buy Here.