Let’s dig into the relative performance of CONMED (NYSE:CNMD) and its peers as we unravel the now-completed Q2 surgical equipment & consumables - diversified earnings season.

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

The 5 surgical equipment & consumables - diversified stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.5%.

In light of this news, share prices of the companies have held steady as they are up 4.1% on average since the latest earnings results.

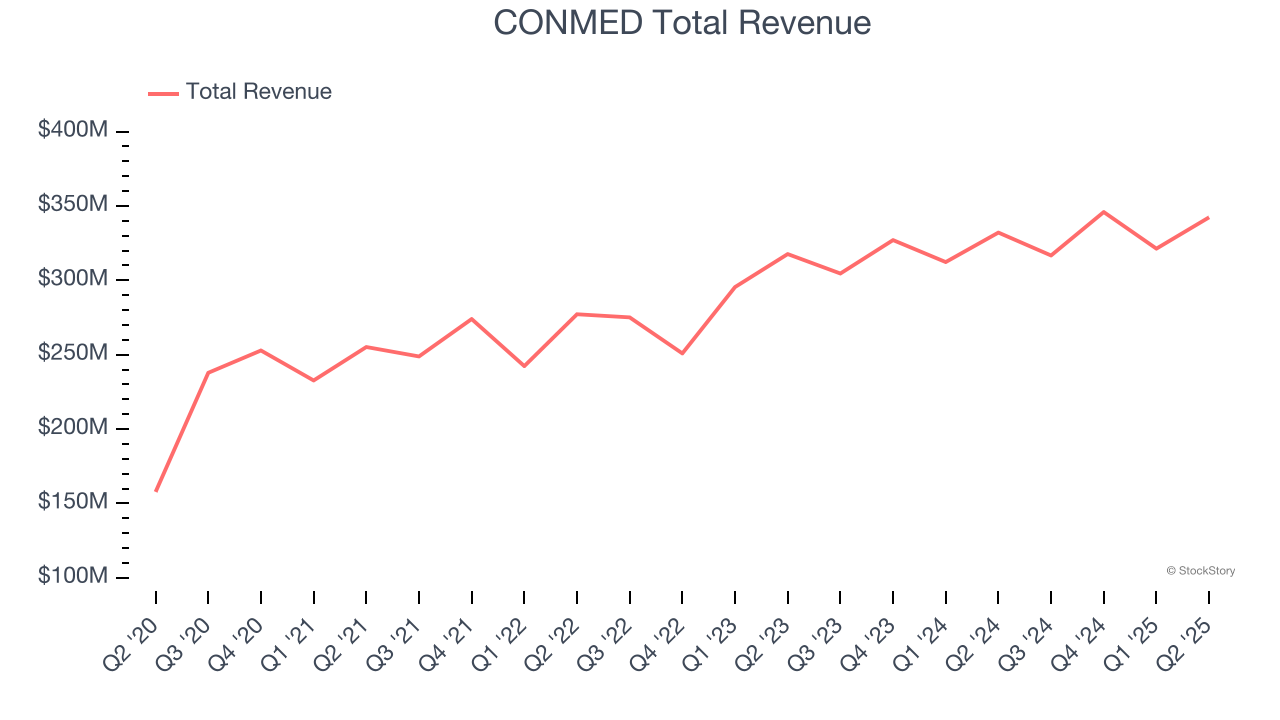

Weakest Q2: CONMED (NYSE:CNMD)

With over five decades of experience in surgical innovation since its founding in 1970, CONMED (NYSE:CNMD) develops and manufactures medical devices and equipment for surgical procedures, specializing in orthopedic and general surgery products.

CONMED reported revenues of $342.3 million, up 3.1% year on year. This print exceeded analysts’ expectations by 1.2%. Overall, it was a satisfactory quarter for the company with a narrow beat of analysts’ full-year EPS guidance estimates.

CONMED delivered the slowest revenue growth and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 10% since reporting and currently trades at $45.19.

Is now the time to buy CONMED? Access our full analysis of the earnings results here, it’s free for active Edge members.

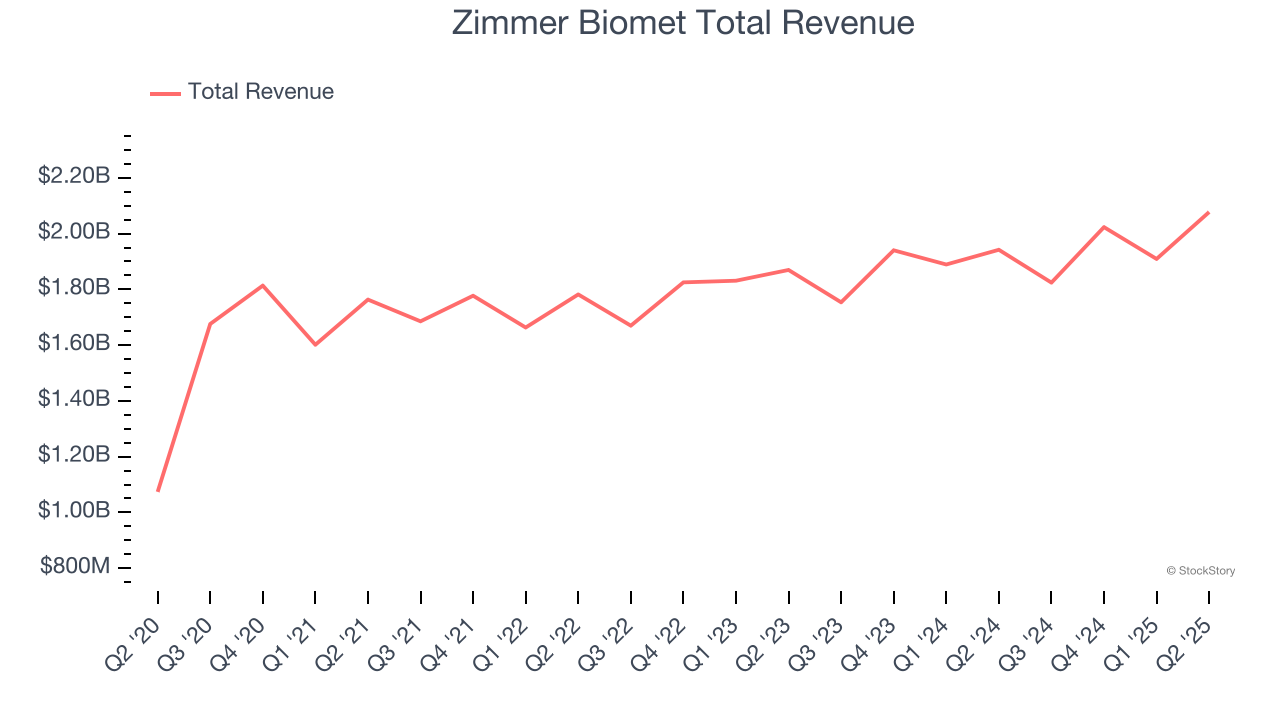

Best Q2: Zimmer Biomet (NYSE:ZBH)

With a history dating back to 1927 and a presence in over 100 countries worldwide, Zimmer Biomet (NYSE:ZBH) designs and manufactures orthopedic products including knee and hip replacements, surgical tools, and robotic technologies for joint reconstruction and spine surgeries.

Zimmer Biomet reported revenues of $2.08 billion, up 7% year on year, outperforming analysts’ expectations by 1.5%. The business had a strong quarter with a solid beat of analysts’ full-year EPS guidance estimates and a decent beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 12.2% since reporting. It currently trades at $102.30.

Is now the time to buy Zimmer Biomet? Access our full analysis of the earnings results here, it’s free for active Edge members.

Solventum (NYSE:SOLV)

Founded in 1985, Solventum (NYSE:SOLV) develops, manufactures, and commercializes a portfolio of healthcare products and services addressing critical customer and therapeutic patient needs.

Solventum reported revenues of $2.16 billion, up 3.8% year on year, exceeding analysts’ expectations by 1.9%. It was a satisfactory quarter as it also posted a beat of analysts’ EPS estimates but a slight miss of analysts’ full-year EPS guidance estimates.

The stock is flat since the results and currently trades at $72.25.

Read our full analysis of Solventum’s results here.

STERIS (NYSE:STE)

With a mission critical role in preventing healthcare-associated infections, STERIS (NYSE:STE) provides infection prevention products, sterilization services, and medical equipment that help healthcare facilities and life science companies maintain sterile environments.

STERIS reported revenues of $1.39 billion, up 8.7% year on year. This print surpassed analysts’ expectations by 2.3%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ constant currency revenue estimates and a solid beat of analysts’ revenue estimates.

STERIS scored the biggest analyst estimates beat among its peers. The stock is up 8.4% since reporting and currently trades at $240.21.

Read our full, actionable report on STERIS here, it’s free for active Edge members.

BD (NYSE:BDX)

With a history dating back to 1897 and a presence in virtually every hospital around the globe, Becton Dickinson (NYSE:BDX) develops and manufactures medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions and professionals worldwide.

BD reported revenues of $5.51 billion, up 8.9% year on year. This result was in line with analysts’ expectations. It was a strong quarter as it also logged an impressive beat of analysts’ constant currency revenue estimates and a beat of analysts’ EPS estimates.

BD achieved the fastest revenue growth and highest full-year guidance raise, but had the weakest performance against analyst estimates among its peers. The stock is up 9.4% since reporting and currently trades at $188.65.

Read our full, actionable report on BD here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.