Power generation products company Generac (NYSE:GNRC) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 5.9% year on year to $942.1 million. Its non-GAAP profit of $1.26 per share was 30.4% above analysts’ consensus estimates.

Is now the time to buy Generac? Find out by accessing our full research report, it’s free.

Generac (GNRC) Q1 CY2025 Highlights:

- Revenue: $942.1 million vs analyst estimates of $919.4 million (5.9% year-on-year growth, 2.5% beat)

- Adjusted EPS: $1.26 vs analyst estimates of $0.97 (30.4% beat)

- Adjusted EBITDA: $148.9 million vs analyst estimates of $129.2 million (15.8% margin, 15.3% beat)

- Full-year revenue guidance lowered: 0-7% growth expected vs prior 3-7%

- Operating Margin: 8.9%, up from 7.5% in the same quarter last year

- Free Cash Flow Margin: 2.9%, down from 9.6% in the same quarter last year

- Market Capitalization: $6.75 billion

“First quarter results exceeded our expectations as a result of continued strong growth in residential product sales,” said Aaron Jagdfeld, President and Chief Executive Officer.

Company Overview

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE:GNRC) offers generators and other power products for residential, industrial, and commercial use.

Sales Growth

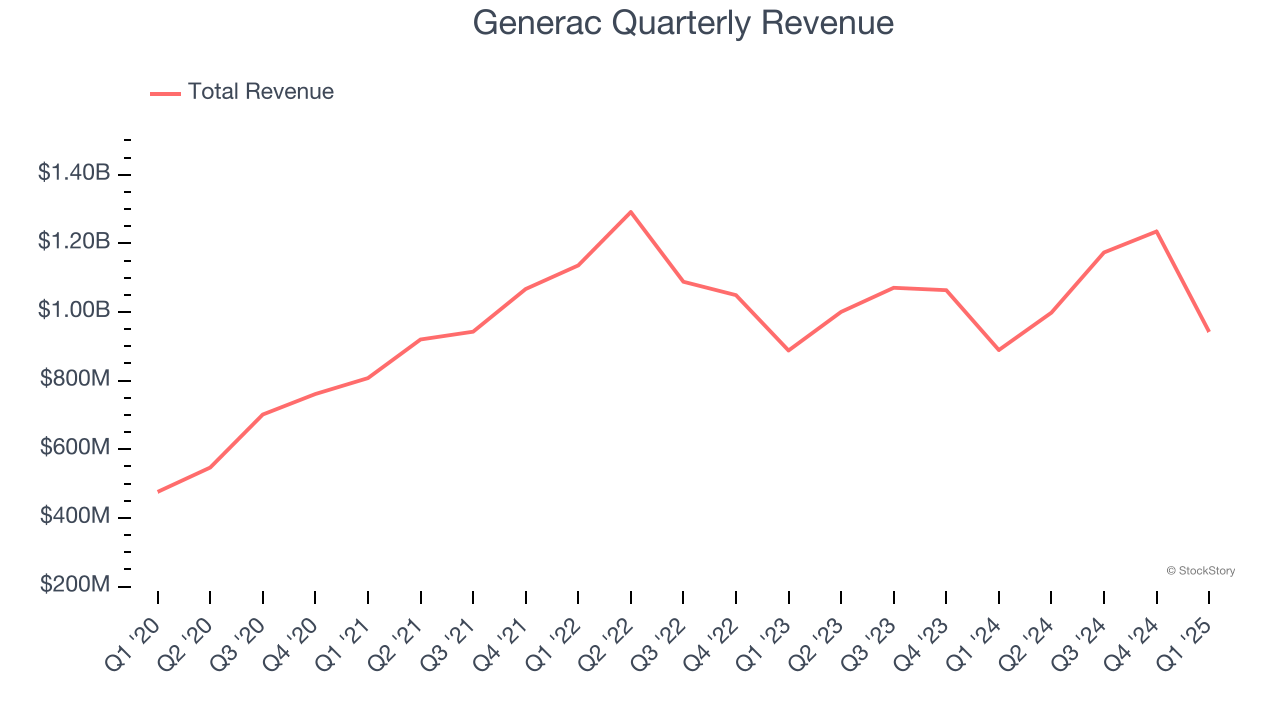

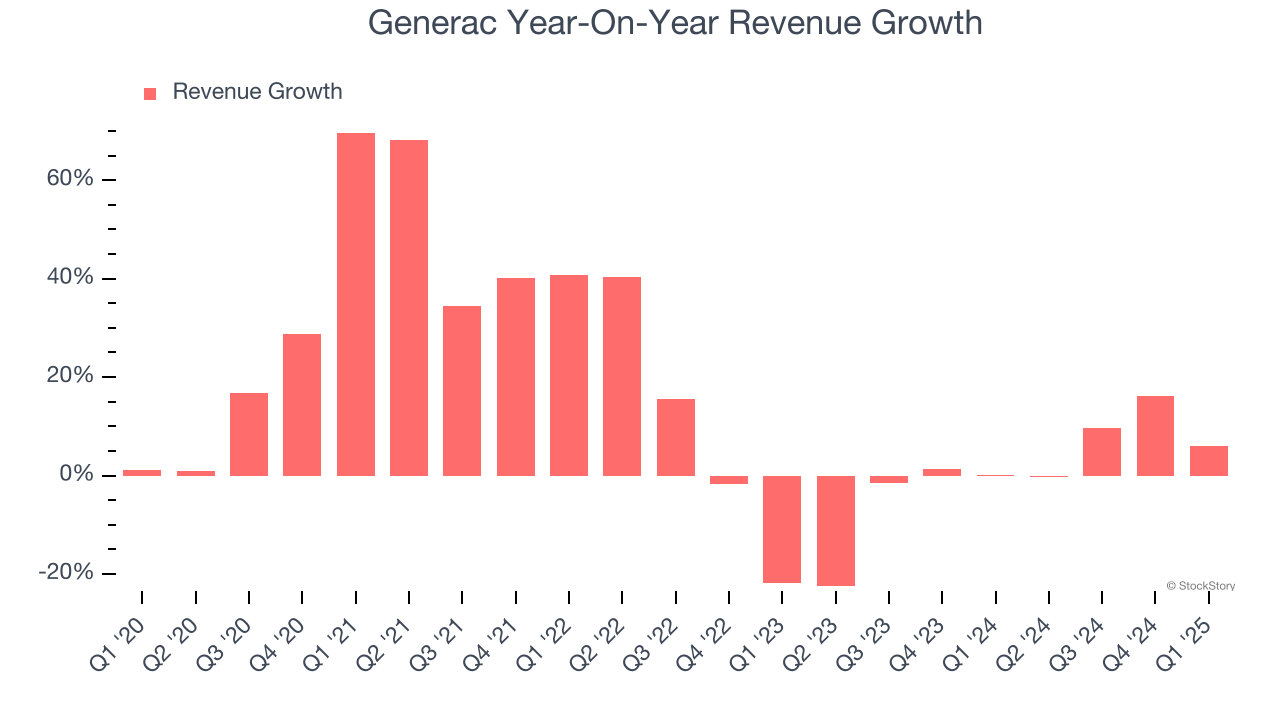

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Generac grew its sales at an exceptional 14.5% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Generac’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years. We also note many other Renewable Energy businesses have faced declining sales because of cyclical headwinds. While Generac’s growth wasn’t the best, it did do better than its peers.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Residential and Commercial and Industrial, which are 52.4% and 35.8% of revenue. Over the last two years, Generac’s Residential revenue (sales to consumers) averaged 2.9% year-on-year growth while its Commercial and Industrial revenue (sales to contractors and pros) averaged 2% growth.

This quarter, Generac reported year-on-year revenue growth of 5.9%, and its $942.1 million of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

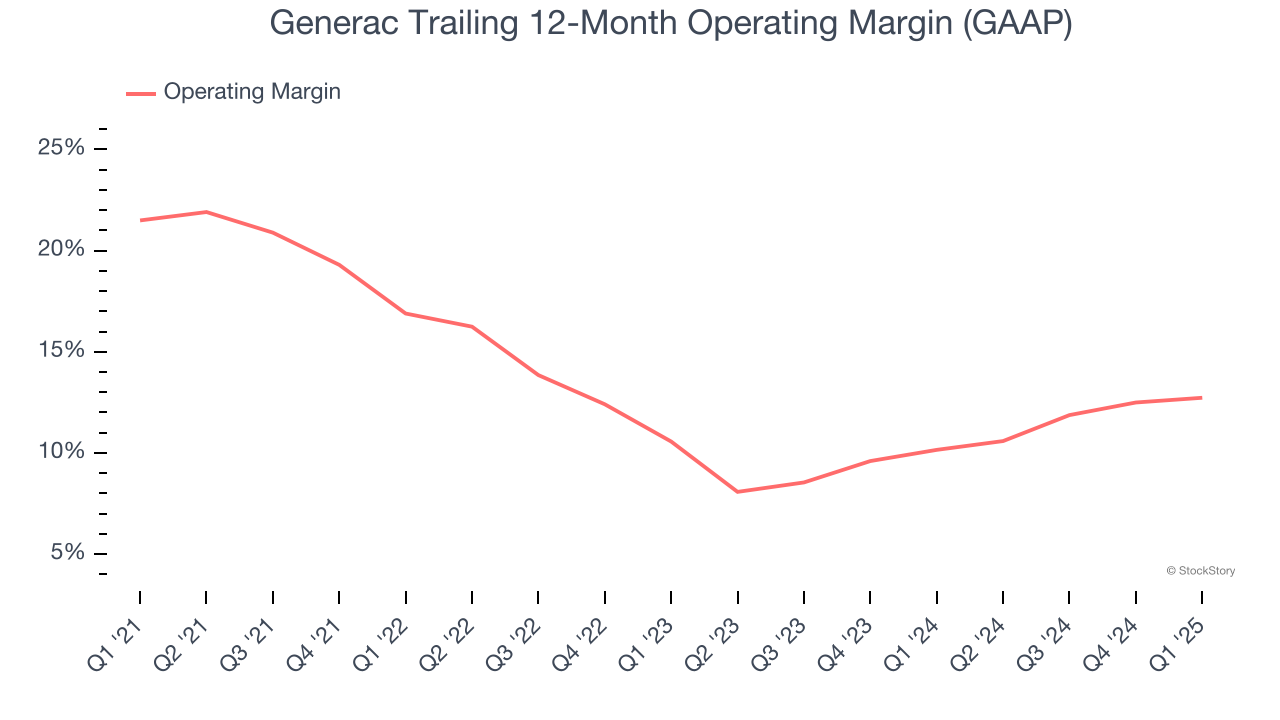

Generac has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Generac’s operating margin decreased by 8.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Generac generated an operating profit margin of 8.9%, up 1.4 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

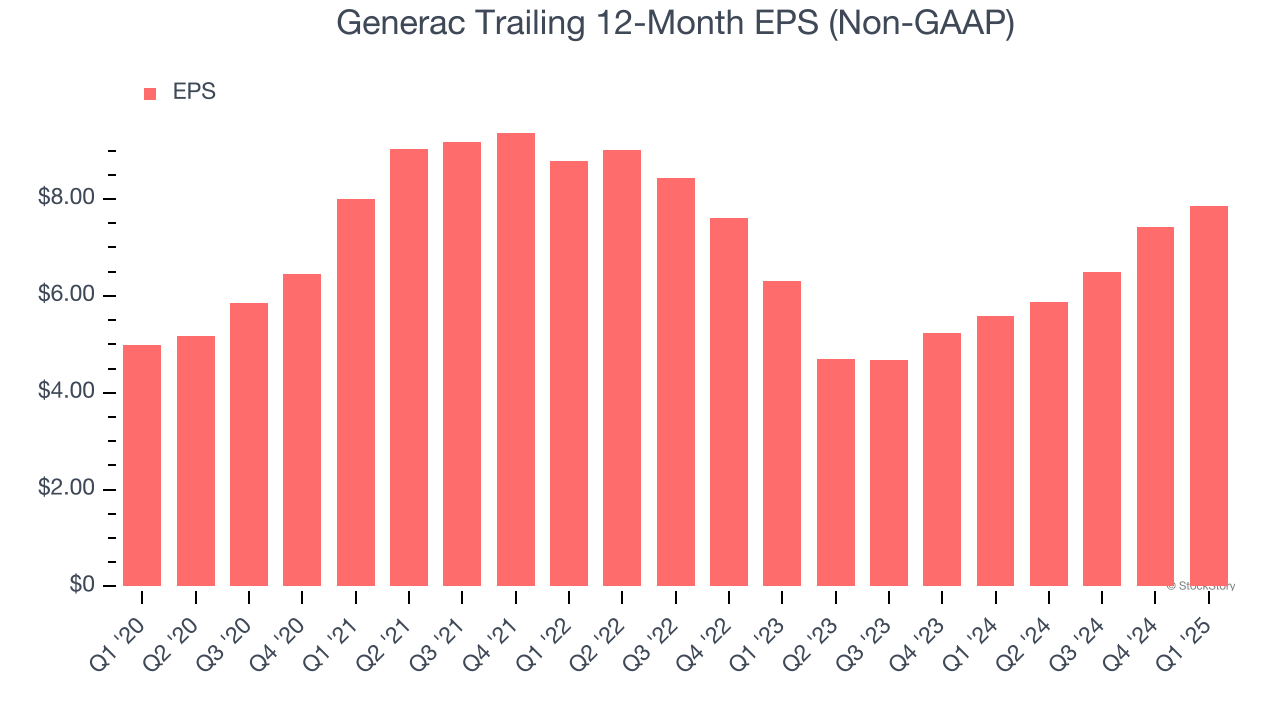

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Generac’s EPS grew at a decent 9.5% compounded annual growth rate over the last five years. However, this performance was lower than its 14.5% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into Generac’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Generac’s operating margin improved this quarter but declined by 8.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Generac, its two-year annual EPS growth of 11.7% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q1, Generac reported EPS at $1.26, up from $0.83 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Generac’s full-year EPS of $7.85 to grow 3.5%.

Key Takeaways from Generac’s Q1 Results

We liked that Generac beat analysts’ revenue and EPS expectations this quarter. On the other hand, full-year revenue guidance was lowered, and this is weighing on shares. The stock traded down 1.5% to $111.51 immediately following the results.

Is Generac an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.