Health insurance company Alignment Healthcare (NASDAQ:ALHC) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 47.5% year on year to $926.9 million. Guidance for next quarter’s revenue was better than expected at $957.5 million at the midpoint, 1.3% above analysts’ estimates. Its GAAP loss of $0.05 per share was 59.7% above analysts’ consensus estimates.

Is now the time to buy Alignment Healthcare? Find out by accessing our full research report, it’s free.

Alignment Healthcare (ALHC) Q1 CY2025 Highlights:

- Revenue: $926.9 million vs analyst estimates of $888.1 million (47.5% year-on-year growth, 4.4% beat)

- EPS (GAAP): -$0.05 vs analyst estimates of -$0.12 (59.7% beat)

- Adjusted EBITDA: $20.18 million vs analyst estimates of $4.40 million (2.2% margin, significant beat)

- The company lifted its revenue guidance for the full year to $3.79 billion at the midpoint from $3.75 billion, a 1.2% increase

- EBITDA guidance for the full year is $49 million at the midpoint, above analyst estimates of $47.1 million

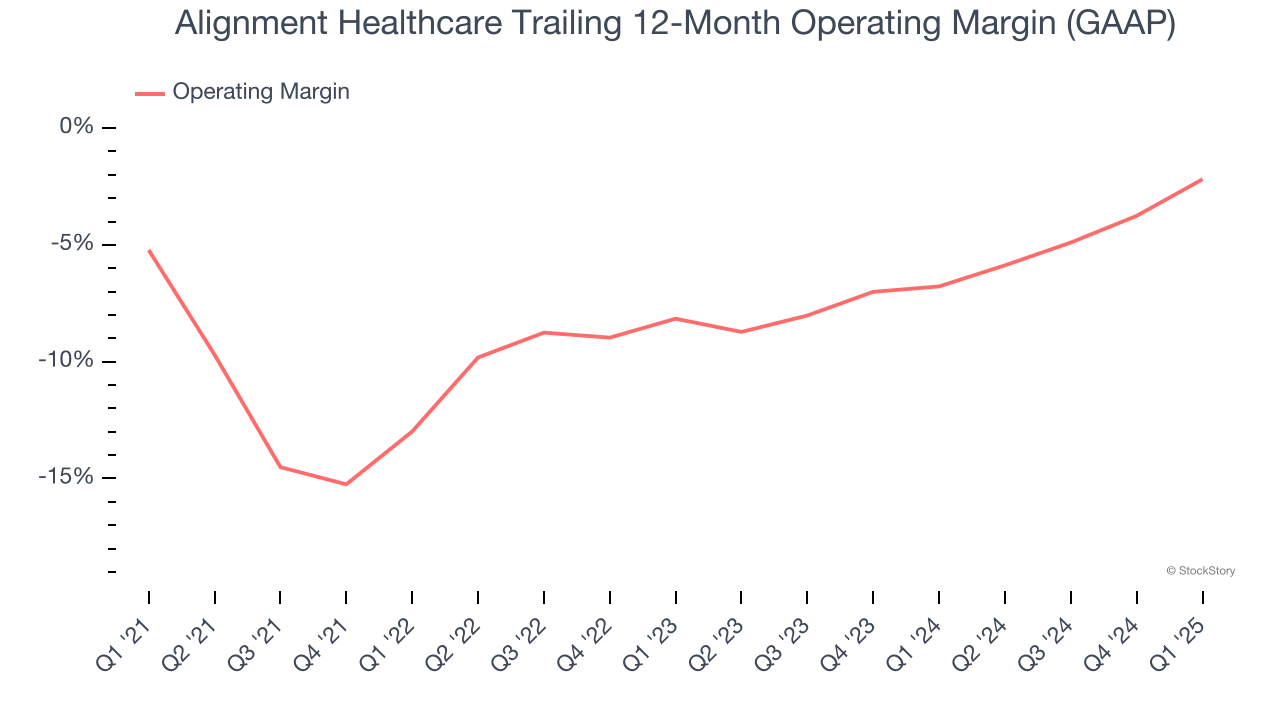

- Operating Margin: -0.6%, up from -6.5% in the same quarter last year

- Free Cash Flow was $8.36 million, up from -$17.36 million in the same quarter last year

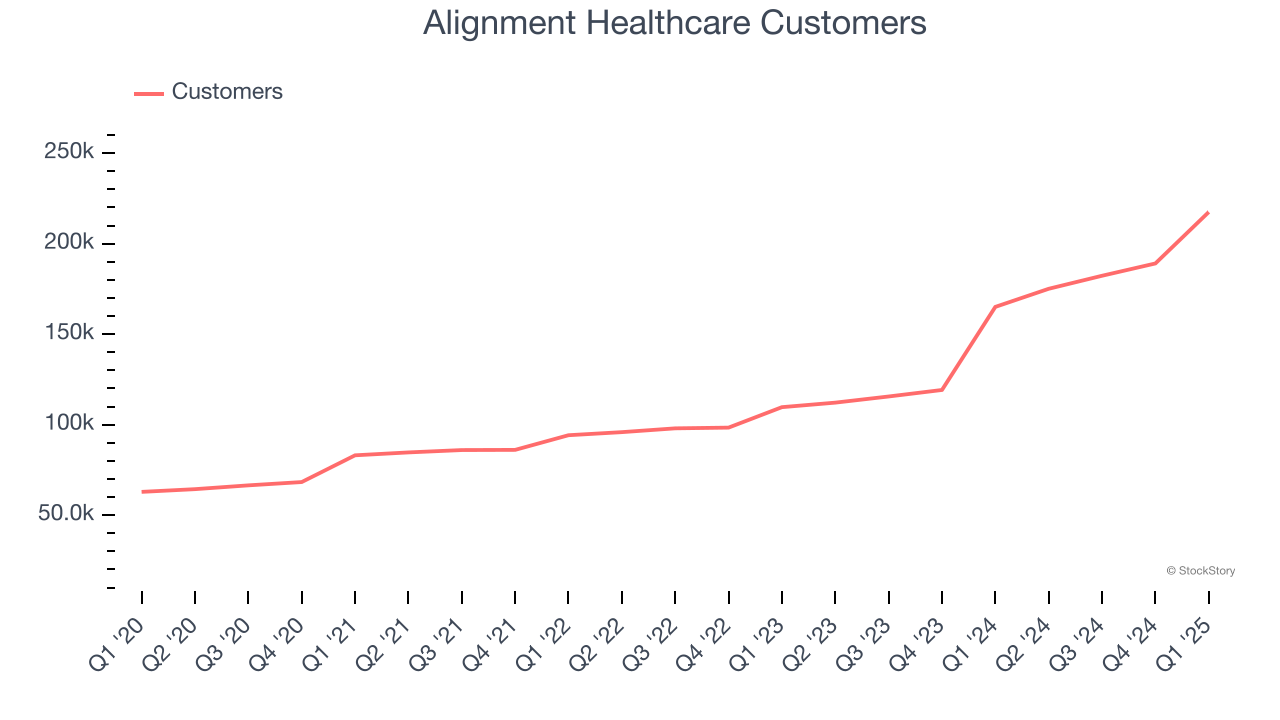

- Customers: 217,500, up from 189,100 in the previous quarter

- Market Capitalization: $3.50 billion

“Alignment Healthcare’s first-quarter performance reflects the strength of our model and the discipline of our execution, showing what’s possible when technology, clinical management and member-first service operate as one,” said John Kao, founder and CEO.

Company Overview

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ:ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

Sales Growth

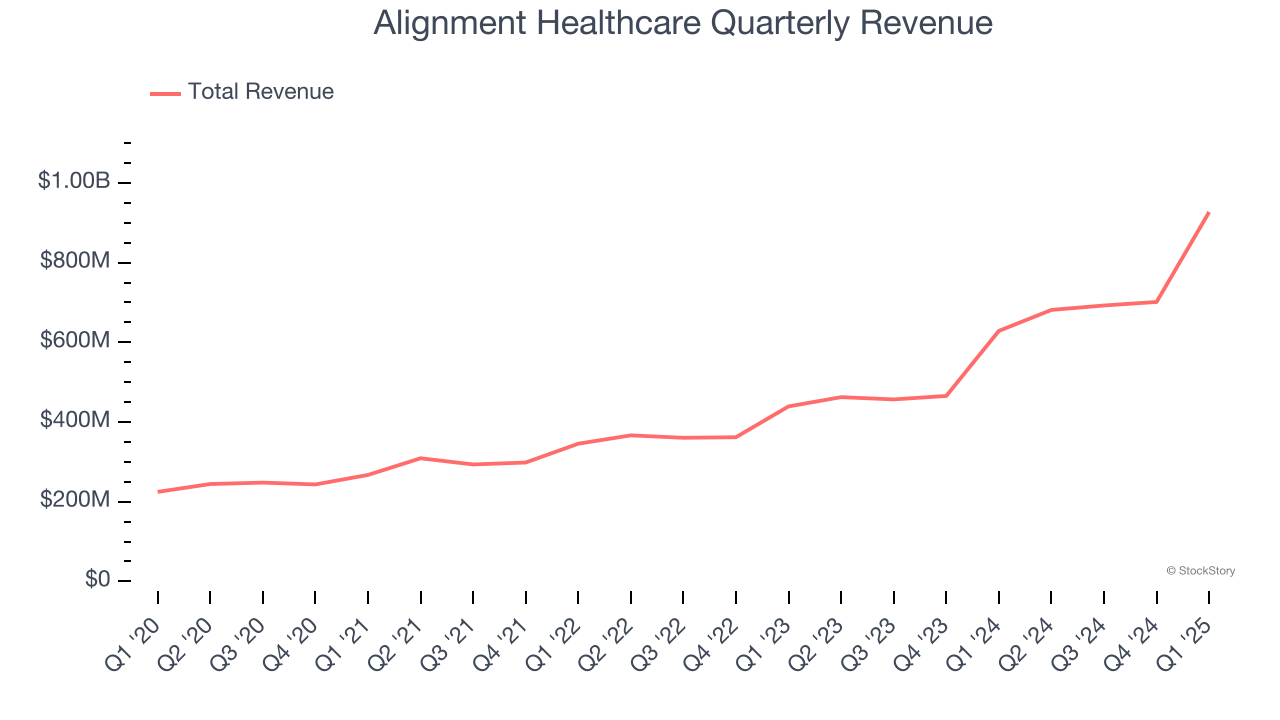

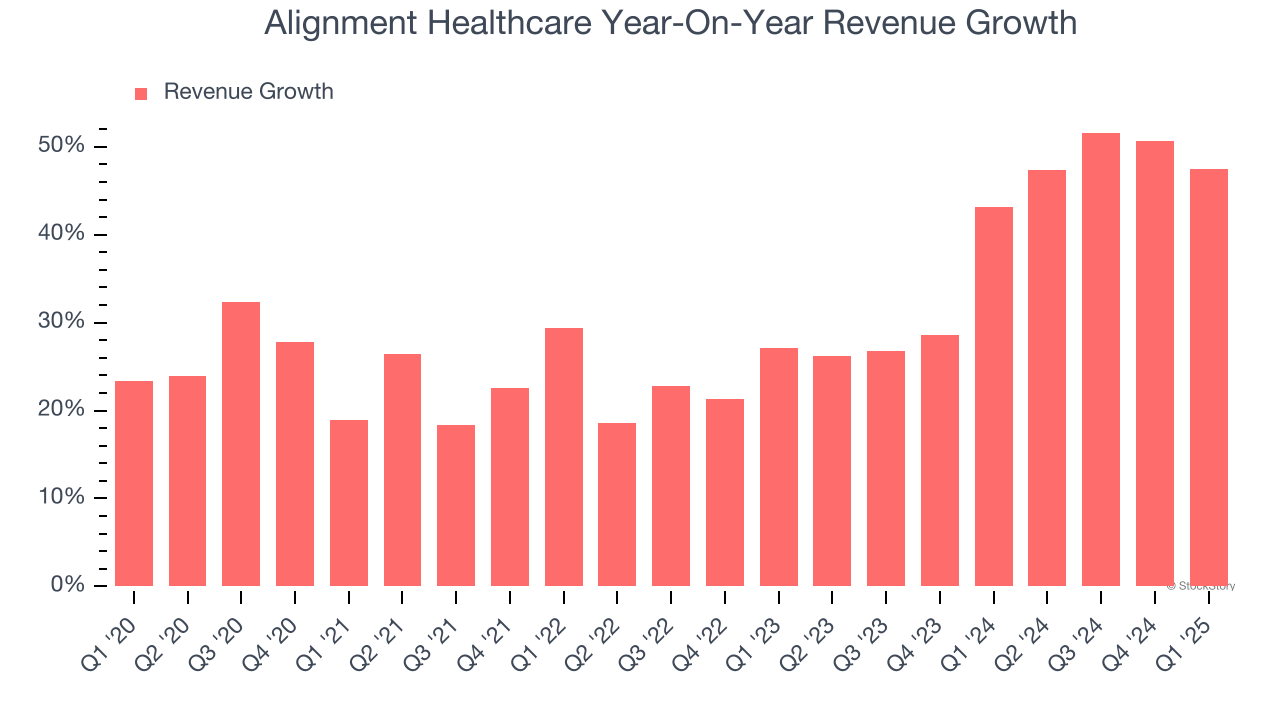

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Alignment Healthcare’s 30.3% annualized revenue growth over the last five years was incredible. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Alignment Healthcare’s annualized revenue growth of 40.2% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its number of customers, which reached 217,500 in the latest quarter. Over the last two years, Alignment Healthcare’s customer base averaged 38.8% year-on-year growth. Because this number is in line with its revenue growth, we can see the average customer spent roughly the same amount each year on the company’s products and services.

This quarter, Alignment Healthcare reported magnificent year-on-year revenue growth of 47.5%, and its $926.9 million of revenue beat Wall Street’s estimates by 4.4%. Company management is currently guiding for a 40.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 32.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although Alignment Healthcare broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Alignment Healthcare’s operating margin rose by 3 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 6 percentage points on a two-year basis. These data points are very encouraging and shows momentum is on its side.

This quarter, Alignment Healthcare generated a negative 0.6% operating margin.

Earnings Per Share

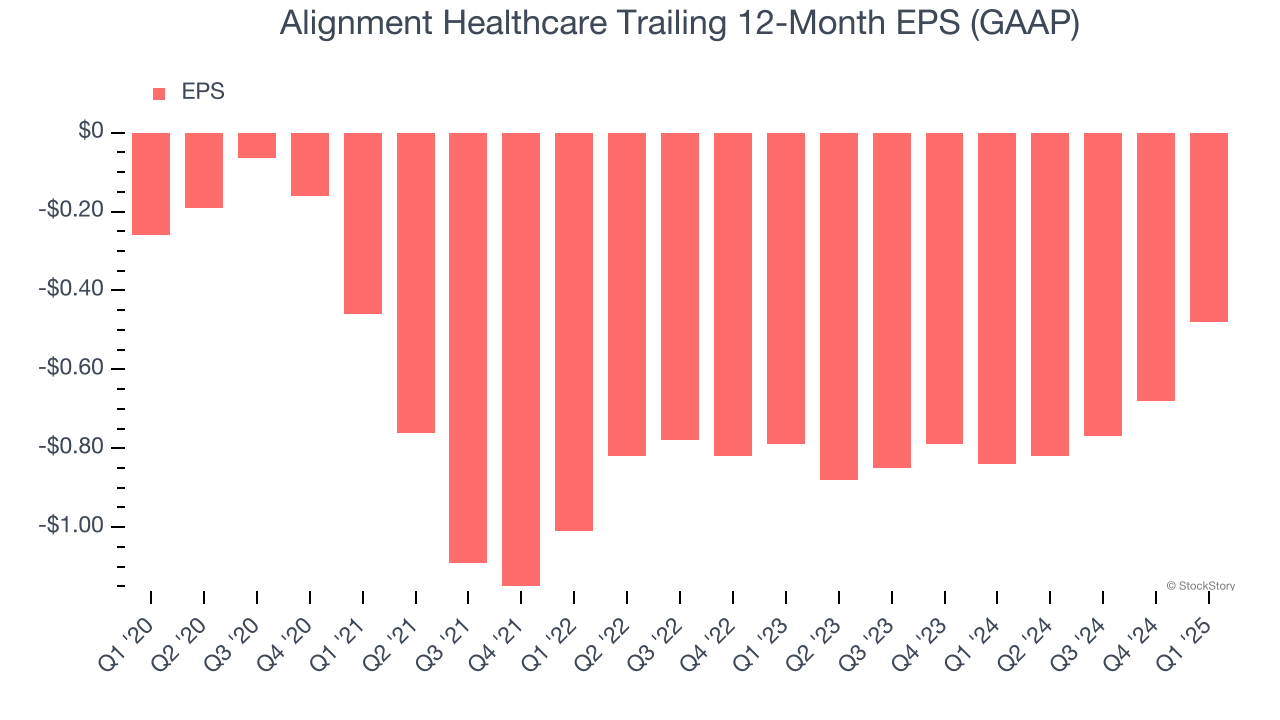

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Alignment Healthcare’s earnings losses deepened over the last five years as its EPS dropped 13.2% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q1, Alignment Healthcare reported EPS at negative $0.05, up from negative $0.25 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Alignment Healthcare’s full-year EPS of negative $0.48 will reach break even.

Key Takeaways from Alignment Healthcare’s Q1 Results

We were impressed by how significantly Alignment Healthcare blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad it raised its full-year revenue and EBITDA guidance. Overall, we think this was a solid quarter with some key metrics above expectations. The stock remained flat at $16.77 immediately after reporting.

Alignment Healthcare may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.