Let’s dig into the relative performance of Accenture (NYSE:ACN) and its peers as we unravel the now-completed Q2 it services & consulting earnings season.

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

The 8 it services & consulting stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 0.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.3% since the latest earnings results.

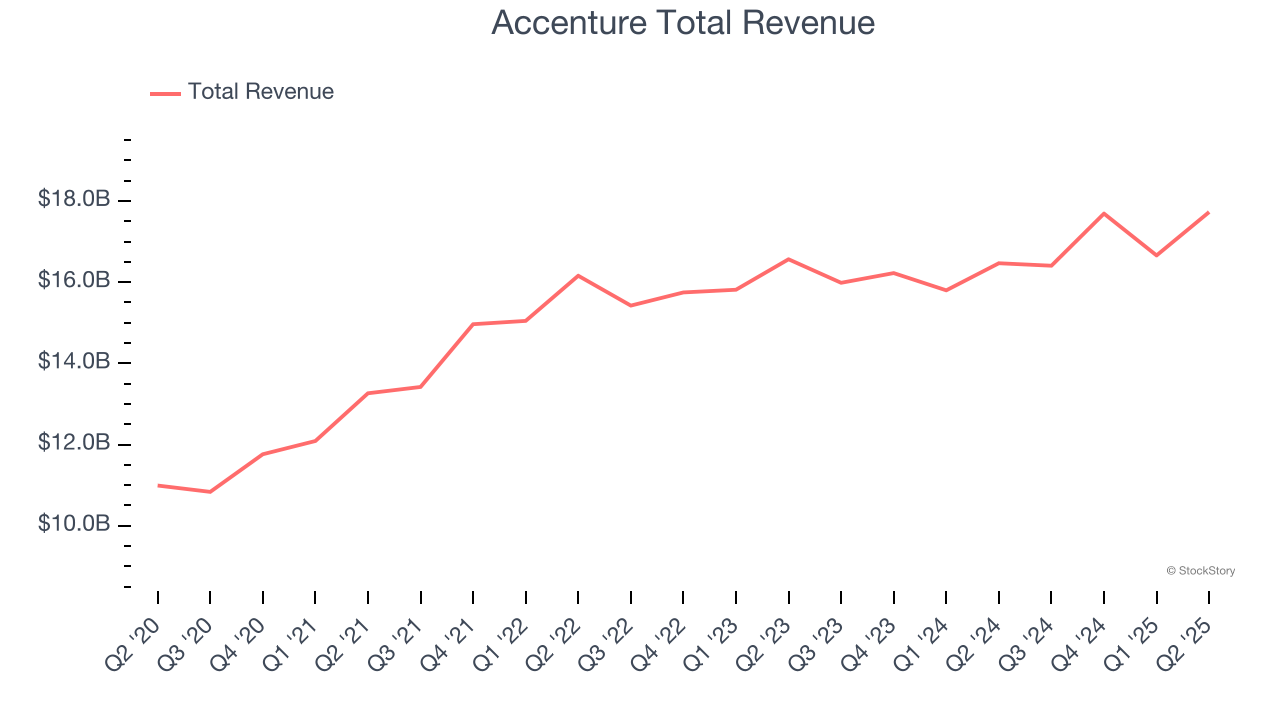

Accenture (NYSE:ACN)

With a workforce of approximately 774,000 people serving clients in more than 120 countries, Accenture (NYSE:ACN) is a professional services firm that helps organizations transform their businesses through consulting, technology, operations, and digital services.

Accenture reported revenues of $17.73 billion, up 7.7% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was a satisfactory quarter for the company with a beat of analysts’ EPS estimates but revenue guidance for next quarter meeting analysts’ expectations.

Unsurprisingly, the stock is down 15.1% since reporting and currently trades at $259.86.

Is now the time to buy Accenture? Access our full analysis of the earnings results here, it’s free.

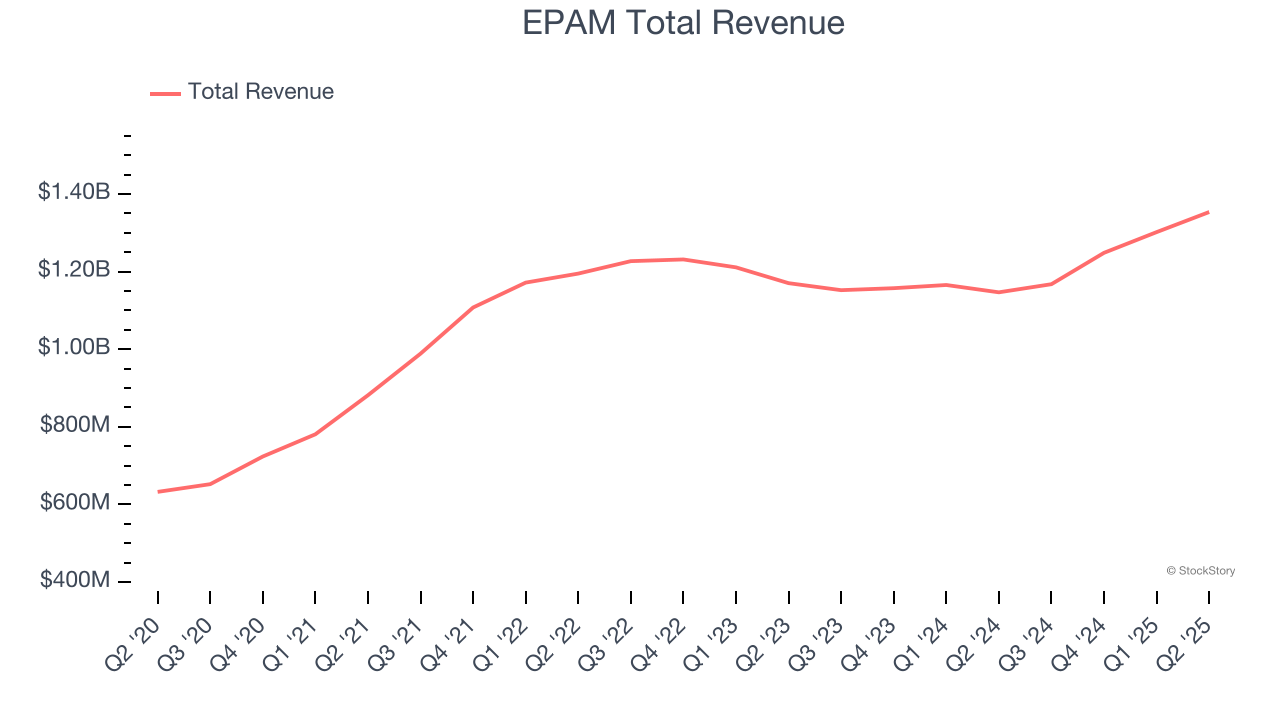

Best Q2: EPAM (NYSE:EPAM)

Founded in 1993 during the early days of offshore software development, EPAM Systems (NYSE:EPAM) provides digital engineering, cloud, and AI transformation services to help global enterprises and startups modernize their technology systems and create digital products.

EPAM reported revenues of $1.35 billion, up 18% year on year, outperforming analysts’ expectations by 1.5%. The business had a strong quarter with an impressive beat of analysts’ EPS guidance for next quarter estimates and a solid beat of analysts’ constant currency revenue estimates.

The market seems happy with the results as the stock is up 16.4% since reporting. It currently trades at $176.36.

Is now the time to buy EPAM? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: ASGN (NYSE:ASGN)

Evolving from its roots in IT staffing to become a high-end technology consulting powerhouse, ASGN (NYSE:ASGN) provides specialized IT consulting services and staffing solutions to Fortune 1000 companies and U.S. federal government agencies.

ASGN reported revenues of $1.02 billion, down 1.4% year on year, exceeding analysts’ expectations by 2.4%. Still, it was a softer quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

Interestingly, the stock is up 8.5% since the results and currently trades at $54.25.

Read our full analysis of ASGN’s results here.

Kyndryl (NYSE:KD)

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl (NYSE:KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

Kyndryl reported revenues of $3.74 billion, flat year on year. This result missed analysts’ expectations by 1.5%. It was a slower quarter as it also produced revenue guidance for next quarter missing analysts’ expectations.

Kyndryl had the weakest performance against analyst estimates among its peers. The stock is down 12.9% since reporting and currently trades at $31.96.

Read our full, actionable report on Kyndryl here, it’s free.

IBM (NYSE:IBM)

With a corporate history spanning over a century and once known for its iconic mainframe computers, IBM (NYSE:IBM) provides hybrid cloud computing platforms, AI solutions, consulting services, and enterprise infrastructure to help businesses modernize their operations.

IBM reported revenues of $16.98 billion, up 7.7% year on year. This number topped analysts’ expectations by 2.4%. Zooming out, it was a mixed quarter as it also recorded an impressive beat of analysts’ operating income estimates but revenue guidance for next quarter missing analysts’ expectations.

The stock is down 13.6% since reporting and currently trades at $243.79.

Read our full, actionable report on IBM here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.