Core & Main’s 31.3% return over the past six months has outpaced the S&P 500 by 20.8%, and its stock price has climbed to $64.72 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy CNM? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does CNM Stock Spark Debate?

Formerly a division of industrial distributor HD Supply, Core & Main (NYSE:CNM) is a provider of water, wastewater, and fire protection products and services.

Two Positive Attributes:

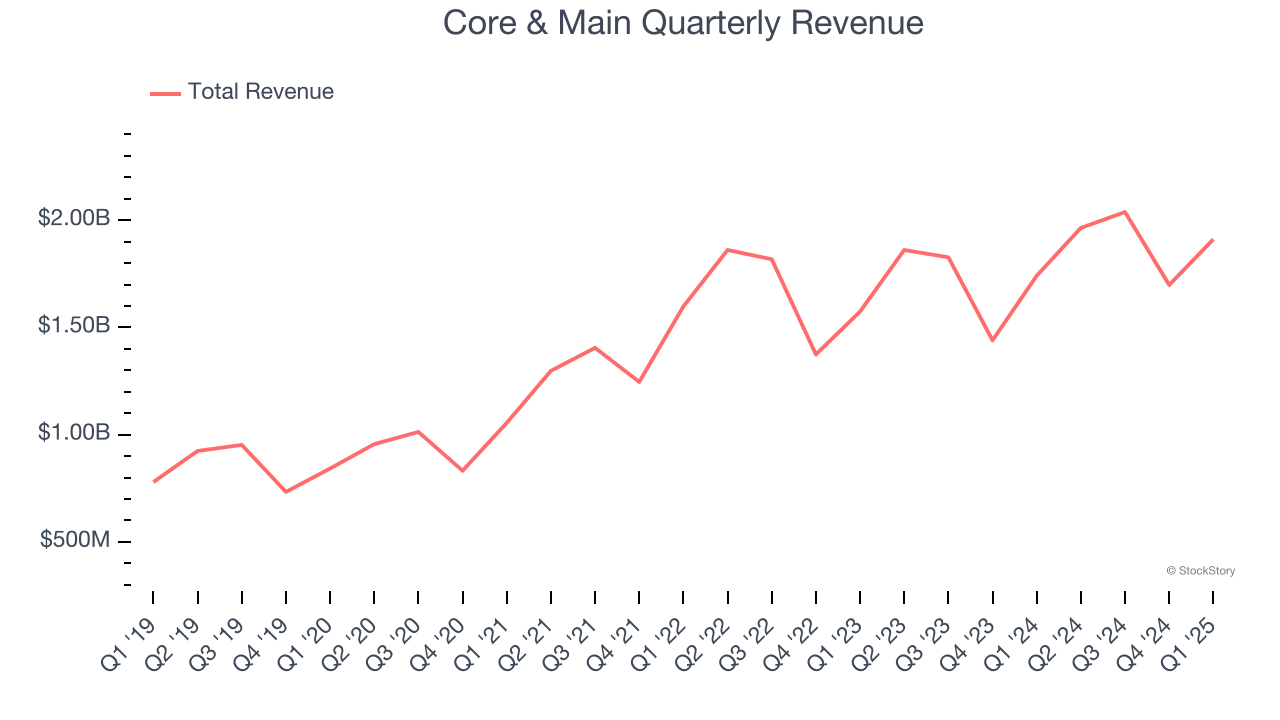

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Core & Main’s sales grew at an incredible 17.1% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

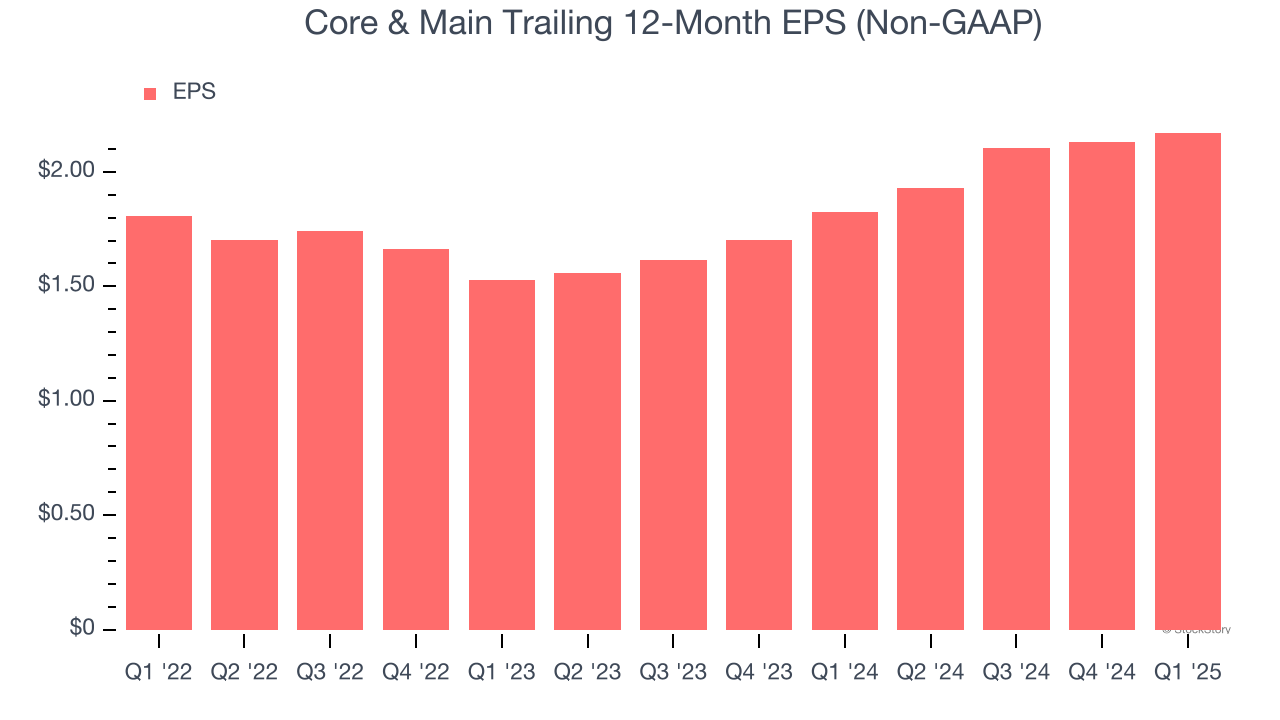

2. EPS Moving Up Steadily

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Core & Main’s full-year EPS grew at a decent 9.3% compounded annual growth rate over the last three years, better than the broader industrials sector.

One Reason to be Careful:

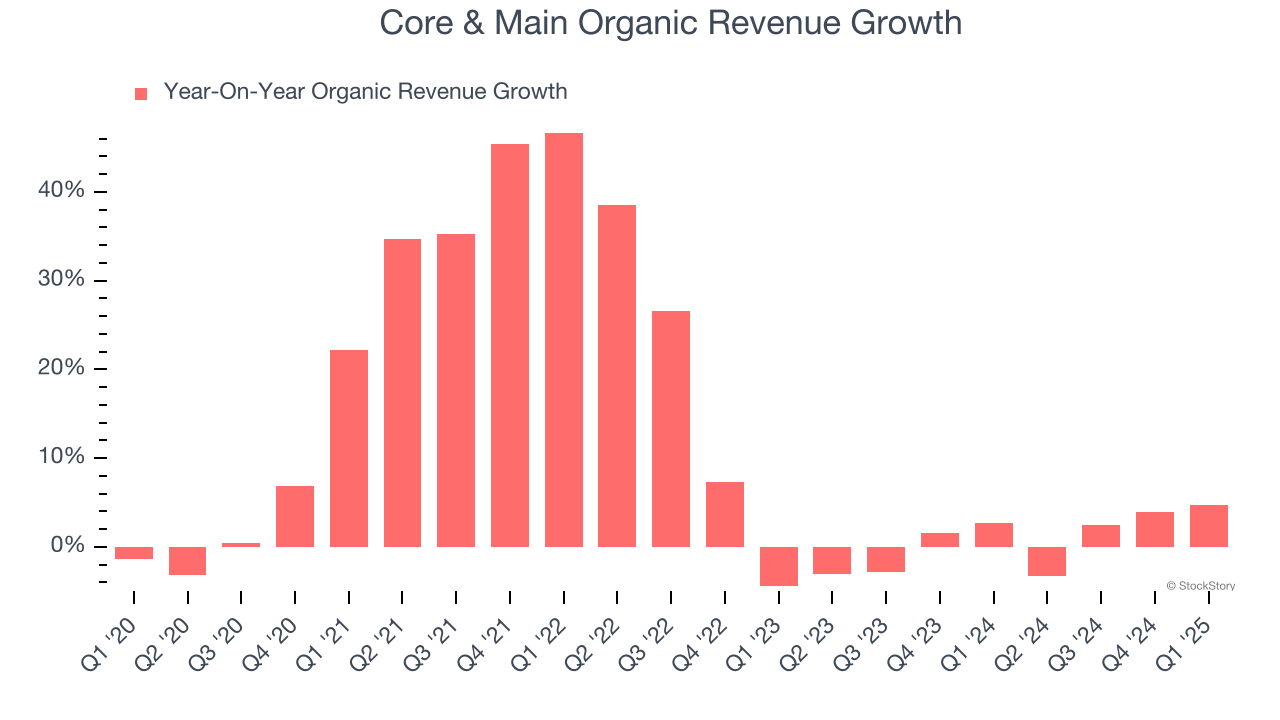

Core Business Falling Behind as Demand Plateaus

We can better understand Infrastructure Distributors companies by analyzing their organic revenue. This metric gives visibility into Core & Main’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Core & Main failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Core & Main might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

Final Judgment

Core & Main’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 26.1× forward P/E (or $64.72 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Core & Main

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.