The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Booking (NASDAQ:BKNG) and the rest of the consumer internet stocks fared in Q2.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 49 consumer internet stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 4.3% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 5.6% on average since the latest earnings results.

Booking (NASDAQ:BKNG)

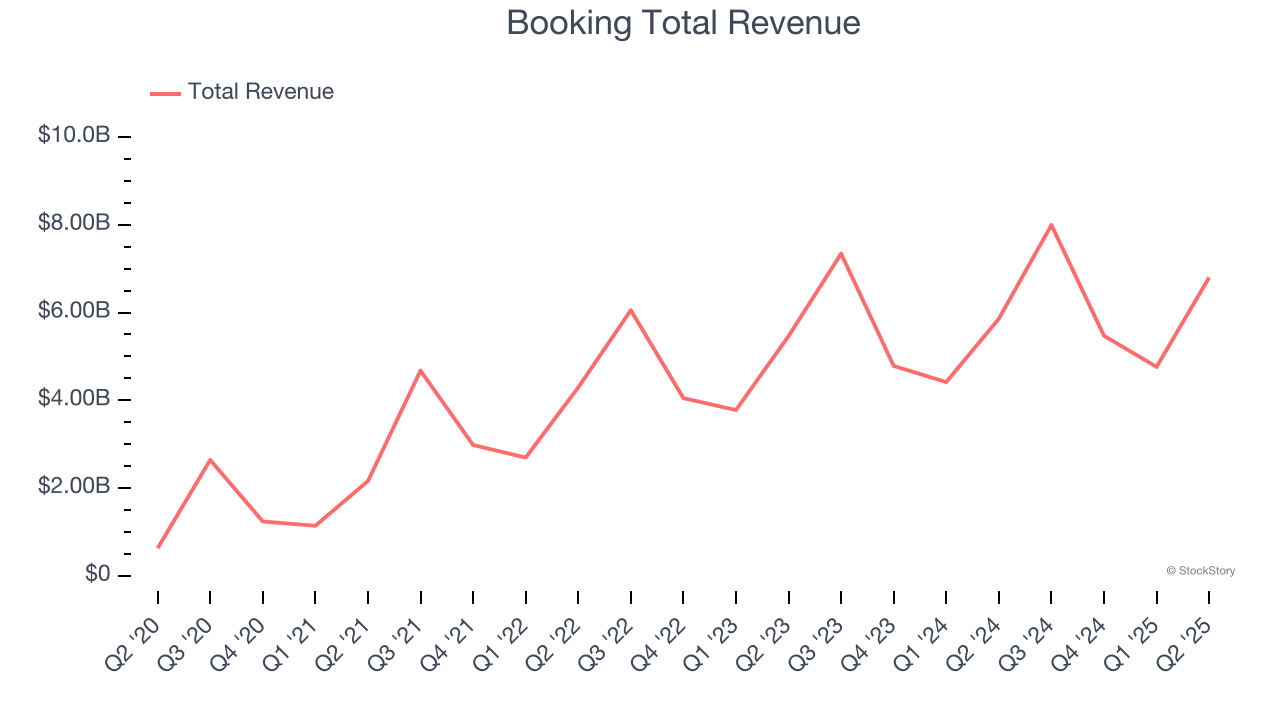

Formerly known as The Priceline Group, Booking Holdings (NASDAQ:BKNG) is the world’s largest online travel agency.

Booking reported revenues of $6.80 billion, up 16% year on year. This print exceeded analysts’ expectations by 3.7%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $5,615.

We think Booking is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q2: Skillz (NYSE:SKLZ)

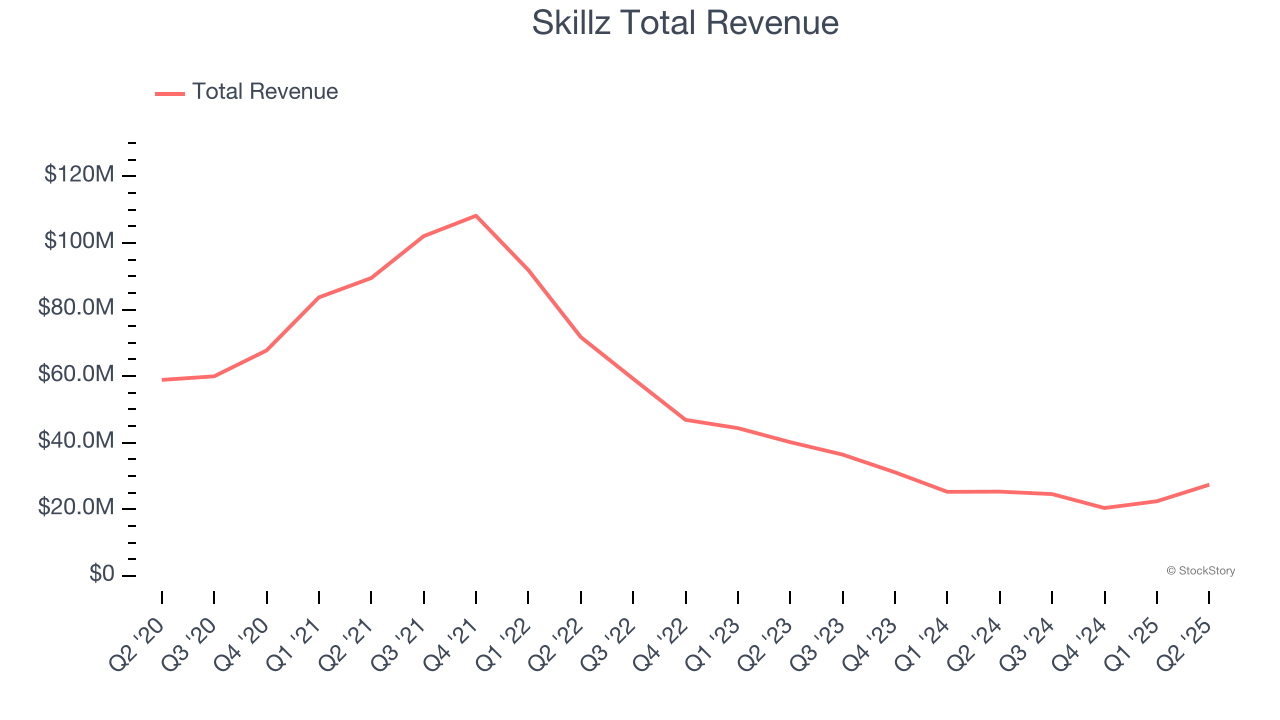

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $27.37 million, up 8.2% year on year, outperforming analysts’ expectations by 19.9%. The business had an incredible quarter with an impressive beat of analysts’ EBITDA and monthly active users estimates.

The market seems happy with the results as the stock is up 30.3% since reporting. It currently trades at $8.65.

Is now the time to buy Skillz? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Coinbase (NASDAQ:COIN)

Widely regarded as the face of crypto, Coinbase (NASDAQ:COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

Coinbase reported revenues of $1.50 billion, up 3.3% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted a significant miss of analysts’ monthly transacting users and EBITDA estimates.

Coinbase delivered the weakest performance against analyst estimates in the group. The company reported 8.7 million monthly active users, up 6.1% year on year. As expected, the stock is down 19.4% since the results and currently trades at $304.21.

Read our full analysis of Coinbase’s results here.

Pinterest (NYSE:PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest reported revenues of $998.2 million, up 16.9% year on year. This result surpassed analysts’ expectations by 2.2%. Zooming out, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EBITDA estimates.

The company reported 578 million monthly active users, up 10.7% year on year. The stock is down 6.9% since reporting and currently trades at $36.51.

Read our full, actionable report on Pinterest here, it’s free.

eBay (NASDAQ:EBAY)

Originally known as the first online auction site, eBay (NASDAQ:EBAY) is one of the world’s largest online marketplaces.

eBay reported revenues of $2.73 billion, up 6.1% year on year. This print topped analysts’ expectations by 3.1%. Taking a step back, it was a mixed quarter as it also produced a solid beat of analysts’ EBITDA estimates but a slight miss of analysts’ number of active buyers estimates.

The company reported 134 million active buyers, up 1.5% year on year. The stock is up 16.8% since reporting and currently trades at $90.40.

Read our full, actionable report on eBay here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.