Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

LLY is surging as its weight-loss duopoly remains a 2026

Via Talk Markets · January 27, 2026

PetroChina has told traders not to buy or trade Venezuela’s oil - a trade that is now under U.S. control after the capture of Nicolas Maduro, trading sources with knowledge of the matter told Reuters on Tuesday.

Via Talk Markets · January 27, 2026

Although rates on other instruments appear to be firming up and even rising, it seems that mortgage rates are very close to moving substantially lower.

Via Talk Markets · January 27, 2026

Traders preparing for FOMC Wednesday should focus on

Via Talk Markets · January 27, 2026

In this video, Ira Epstein discusses the current state of the financial markets, highlighting the impact of the US government's insufficient Medicare payment increase on healthcare stocks...

Via Talk Markets · January 27, 2026

Revaluing US gold from $42/oz to market rates could inject $1T into the Treasury without new debt. Aimed at boosting the economy before the 2026 midterms, this move is bullish for stocks and gold but risks long-term inflation by 2027.

Via Talk Markets · January 27, 2026

This analysis challenges the traditional

Via Talk Markets · January 27, 2026

The oil markets had a mixed day today.

Via Talk Markets · January 27, 2026

A recap on an important warning to baby boomers in target date funds

Via Talk Markets · January 27, 2026

So while the S&P 500 grinds higher, mainly due to the implied volatility dispersion trade ahead of earnings from the mega-cap technology names, implied volatility on the index is rising, too.

Via Talk Markets · January 27, 2026

US money market balances are near a record $8T as cautious investors seek safety amid low consumer sentiment. What does the US money market balance tell us, and what does it mean for investors?

Via Talk Markets · January 27, 2026

Unlike the 2022 UK crisis, Japan’s rising bond yields coincide with climbing stock prices. This suggests growth-driven rates rather than a fiscal crash, though markets remain wary of PM Takaichi’s tax pause ahead of the upcoming snap election.

Via Talk Markets · January 27, 2026

Gold price (XAU/USD) rises to near a fresh record high around $5,160 during the early Asian session on Wednesday.

Via Talk Markets · January 27, 2026

GBP/USD is well on its way to a second straight week of strong gains as the US Dollar (USD) gives up the ghost on the back of ongoing trade war rhetoric undercutting the Greenback’s strength.

Via Talk Markets · January 27, 2026

If yesterday's 2Y auction was stellar, today's 5Y sale was the opposite.

Via Talk Markets · January 27, 2026

2025 concluded with a significant divergence in global equity performance.

Via Talk Markets · January 27, 2026

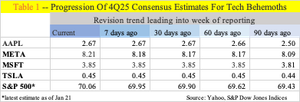

Four of the Magnificent 7 report this week and carry potential to sway large-cap indices that are weighted by market cap.

Via Talk Markets · January 27, 2026

The AI boom is creating huge opportunities for plenty of companies besides the giant tech names.

Via Talk Markets · January 27, 2026

Gold and silver are increasingly being treated as real collateral in a world burdened by unsustainable debt, currency debasement, and geopolitical fragmentation.

Via Talk Markets · January 27, 2026

Gold and silver came in struggling, but rocketed higher in the late day trade as the Dollar continued its cascading decline.

Via Talk Markets · January 27, 2026

Silver rises over 5% weekly as US trade-war tensions revive aggressive 'sell America' positioning.

Via Talk Markets · January 27, 2026

A falling dollar makes imports more expensive. Trump is cheering inflation.

Via Talk Markets · January 27, 2026

Markets head into the North American open, navigating renewed FX volatility.

Via Talk Markets · January 27, 2026

Following a sharp sell-off in recent days, the USD/JPY is looking a little overextended on the downside.

Via Talk Markets · January 27, 2026

freenet AG has declared and paid variable annual dividends since May 2022. The declared, June 2025 Annual dividend of $1.05 gives a hint of what could be declared for the coming year.

Via Talk Markets · January 27, 2026

For the fourth straight month, US home prices rose on a MoM basis in November.

Via Talk Markets · January 27, 2026

At the press conference following the Federal Reserve's rate decision, Chair Powell is not likely to talk about the things we want to know.

Via Talk Markets · January 27, 2026

Japan’s bond market is blowing up.

Via Talk Markets · January 27, 2026

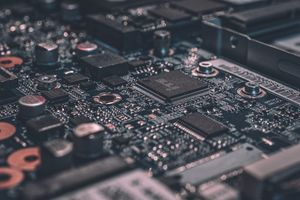

The explosive growth of AI data centers has ignited unprecedented demand for NAND flash and other memory solutions, propelling Micron Technology from a stagnant performer to a market darling.

Via Talk Markets · January 27, 2026

No doubt the USD is losing in value in nominal terms against a basket of currencies as well gold, since the weekend.

Via Talk Markets · January 27, 2026

Today it was the turn of the S&P and Nasdaq to make their moves as the Russell 2000 takes a rest after its breakout.

Via Talk Markets · January 27, 2026

RTX could be worth 10% more at $217.00 or higher. Buying long-dated in-the-money (ITM) call options could work for investors, as this article will show.

Via Talk Markets · January 27, 2026

The S&P 500 settled at a record high on Tuesday as Big Tech powered gains, with the Nasdaq also securing a win as the Dow slid 408 points.

Via Talk Markets · January 27, 2026

As Europe retreats into energy dependence and ideological paralysis, U.S. midstream energy companies accelerate geopolitical leverage.

Via Talk Markets · January 27, 2026

The latest Case Shiller home price data from S&P Cotality was published today and showed a small month-over-month decline of 0.11% at the national level.

Via Talk Markets · January 27, 2026

The Canadian Dollar rose sharply against the U.S. Dollar on Tuesday.

Via Talk Markets · January 27, 2026

Gold is not responding to inflation prints, geopolitics, or speculative excess. It is reacting to a structural shift in how policymakers manage stress inside the financial system.

Via Talk Markets · January 27, 2026

Stocks can stay overbought for weeks while shorts get carried out on stretchers. The traders who survive earnings season understand something you do not.

Via Talk Markets · January 27, 2026

Year-over-year shipments have been negative every month starting February 2023. That’s 35 straight months of negative year-over-year declines in shipments.

Via Talk Markets · January 27, 2026

We examine what may be shaping up to be a perfect storm for global markets.

Via Talk Markets · January 27, 2026

Palm Oil futures were higher on idea of increasing seasonal demand. There are still ideas of increasing production.

Via Talk Markets · January 27, 2026

Gold rises over 0.60% as US–South Korea trade tensions fuel haven demand across markets.

Via Talk Markets · January 27, 2026

The stock market is standing at a historic crossroads.

Via Talk Markets · January 27, 2026

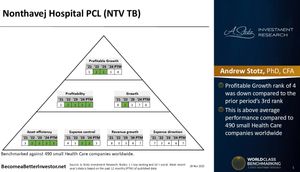

Nonthavej Hospital Public Company Limited operates a tertiary private hospital providing 24-hour medical services in Nonthaburi, Thailand.

Via Talk Markets · January 27, 2026

In 2025, the S&P 500 recorded strong performance, driven by ongoing momentum. The S&P 500 Market Leaders Index also performed well compared to its benchmark.

Via Talk Markets · January 27, 2026

XRP is following silver’s 45-year price pattern on a shorter scale, raising speculation about a potential breakout phase ahead.

Via Talk Markets · January 27, 2026

Richtech Robotics stock jumped more than 10% after the company announced a new AI collaboration with Microsoft focused on upgrading its robotic systems.

Via Talk Markets · January 27, 2026

The electric vehicle maker lost an estimated $15.4 billion in brand value last year, a drop of about 36%, reflecting weakening consumer sentiment despite the company’s continued prominence in global markets.

Via Talk Markets · January 27, 2026

Perhaps the easiest, most profitable strategy in investing is to simply follow the smart money.

Via Talk Markets · January 27, 2026

“Confidence collapsed in January.” But Why?

Via Talk Markets · January 27, 2026

Consumer confidence readings paint a much weaker picture than is suggested by spending data. This likely reflects the bifurcation story whereby spending is being driven by a relatively small cohort of high-income households...

Via Talk Markets · January 27, 2026

While natural gas prices are correcting sharply, the key will be the weather.

Via Talk Markets · January 27, 2026

The Pound Sterling soars during Tuesday’s North American session as the US Dollar continues to weaken due to trade tariff escalation ahead of the first Federal Reserve (Fed) monetary policy meeting of 2026.

Via Talk Markets · January 27, 2026

The Dow Jones Industrial Average is continuing its staggering pullback, off 350 points at midday, dragged by struggling UnitedHealth Group.

Via Talk Markets · January 27, 2026

The Bank of Canada will hold its first monetary policy meeting on Wednesday, just hours before its US counterpart.

Via Talk Markets · January 27, 2026

London's FTSE 100 extended Monday’s meagre gains on Tuesday, buoyed by robust performances in heavyweight banking stocks.

Via Talk Markets · January 27, 2026

Tomorrow’s Fed decision is adding to the wild action in the metals market. The white metals all experienced huge price swings on Monday.

Via Talk Markets · January 27, 2026

Home sales lead house prices, and that trend continued with the Case Shiller and FHFA repeat sales house price indexes through November, released this morning.

Via Talk Markets · January 27, 2026

Boeing's stock fell 2% following its Q4 earnings report on January 27, 2026, as investors reacted to ongoing manufacturing delays and a wider-than-expected quarterly loss.

Via Talk Markets · January 27, 2026

Silver pulled back from recent highs amid geopolitical and political uncertainty.

Via Talk Markets · January 27, 2026

General Motors exceeded Wall Street’s fourth-quarter earnings expectations and forecast another year of “strong financial performance” in 2026. While revenue fell slightly short, the company announced a 20% dividend increase

Via Talk Markets · January 27, 2026

In this video, Ira Epstein provides a morning update on financial markets, focusing on the significant declines in metal prices, particularly platinum and silver, and advises caution in trading given the volatile conditions.

Via Talk Markets · January 27, 2026

Uncertainty surrounding the future policies of the US Federal Reserve has weakened the US Dollar against other major currencies across trusted trading platforms.

Via Talk Markets · January 27, 2026

Gold stabilizes after a modest pullback from record highs.

Via Talk Markets · January 27, 2026

Gold remains firm near recent highs as conflict, trade tensions, and Fed uncertainty drive safe-haven demand.

Via Talk Markets · January 27, 2026

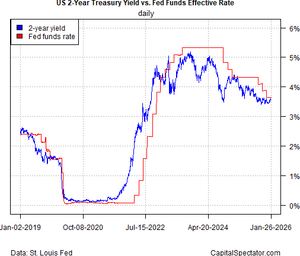

The Federal Reserve is expected to leave its target rate unchanged at tomorrow’s policy meeting, marking a shift after three straight cuts in 2025.

Via Talk Markets · January 27, 2026

Microsoft is preparing to report its quarterly results after the market closes on January 28, 2026, and the stock’s technical picture has shown growing signs of bearish tension in recent months.

Via Talk Markets · January 27, 2026

The greenback is mostly softer against the G10 currencies today.

Via Talk Markets · January 27, 2026

An unprecedented shakeup at the very top of the Chinese military has shaken up the rest of the world.

Via Talk Markets · January 27, 2026

DXY is showing a strong reaction lower taking place, right after ending the correction within the equal legs area.

Via Talk Markets · January 27, 2026

United Parcel Service reported Q4 2025 earnings of $2.38 per share on revenue of $24.5 billion, beating expectations and reinforcing confidence in its 2026 outlook.

Via Talk Markets · January 27, 2026

USD/JPY settled at 154.29 on Tuesday, with the yen pausing its rally after a notable surge of nearly 3.2% in the previous two sessions.

Via Talk Markets · January 27, 2026

Volume, TPO and VWAP levels offer structured trade scenarios with clear invalidation points.

Via Talk Markets · January 27, 2026

The Nasdaq looks set to open in the green, with traders waking up to the prospect of a fresh post-earnings surge for Mag7 stocks.

Via Talk Markets · January 27, 2026

It’s the time of the quarter when earnings season kicks off to shake the markets up.

Via Talk Markets · January 27, 2026