American Airlines Group, Inc. - Common Stock (AAL)

11.11

+0.00 (0.00%)

NASDAQ · Last Trade: Mar 11th, 4:12 AM EDT

Analyst cuts, surging options activity, and Middle East tensions put this airline’s outlook under scrutiny today, March 10, 2026.

Via The Motley Fool · March 10, 2026

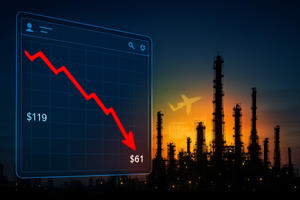

NEW YORK — In a dramatic reversal that has caught energy traders off guard, West Texas Intermediate (WTI) crude oil prices plummeted on Tuesday, March 10, 2026, falling into the $81 to $90 range after hitting a terrifying weekend high of nearly $119 per barrel. This sharp 25% retreat from the

Via MarketMinute · March 10, 2026

Via MarketBeat · March 10, 2026

Curious about the most active stocks on Tuesday?chartmill.com

Via Chartmill · March 10, 2026

American Airlines (AAL) has reached a support level. In addition, a reversal pattern has formed on the chart.

Via Benzinga · March 10, 2026

Global energy markets experienced a historic correction on March 10, 2026, as crude oil prices plummeted from recent multi-year highs. Benchmark West Texas Intermediate (WTI) fell sharply to settle between $88 and $89 per barrel, while Brent crude, the international standard, dropped to $92. The sudden retreat marks a significant

Via MarketMinute · March 10, 2026

In a day defined by historic whiplash, the global energy markets witnessed a dramatic cooling on March 10, 2026. Crude oil prices, which had flirted with $120 per barrel just hours earlier amidst fears of a prolonged Middle Eastern conflagration, plummeted 6.25% to settle at $88.85 USD/Bbl.

Via MarketMinute · March 10, 2026

On March 9, 2026, the airline erased some of its losses on reports that Iran conflict may soon end.

Via The Motley Fool · March 9, 2026

The global aviation sector faced a brutal awakening on Monday, March 9, 2026, as airline stocks plummeted in pre-market and early morning trading. The catalyst for the sell-off was a dramatic surge in crude oil prices, which breached the psychological $100-per-barrel mark following an escalating geopolitical crisis in the Middle

Via MarketMinute · March 9, 2026

These stocks are making the most noise in today's session.chartmill.com

Via Chartmill · March 9, 2026

What Happened? Shares of airline company United Airlines Holdings (NASDAQ:UAL) fell 5.9% in the morning session after the ongoing war in the Middle East drov...

Via StockStory · March 9, 2026

As of March 9, 2026, the global aviation landscape has undergone a profound transformation, and at the center of this shift stands United Airlines Holdings, Inc. (NASDAQ: UAL). Once a legacy carrier struggling with labor relations and operational inconsistencies, United has reinvented itself over the last five years into an aggressive, premium-focused international powerhouse. Driven [...]

Via Finterra · March 9, 2026

On March 9, 2026, global financial markets are reeling as Brent crude oil prices surged toward $120 per barrel, driven by a rapid military escalation between the United States and Iran. The benchmark West Texas Intermediate (WTI) has concurrently eclipsed $111 per barrel, trading near $118.82 as traders price

Via MarketMinute · March 9, 2026

By: MarketMinute

The global energy landscape fractured on Monday, March 9, 2026, as Brent crude prices skyrocketed past $115 per barrel, marking a staggering 24% increase from Friday’s close. In a session defined by raw panic and historic volatility, West Texas Intermediate (WTI) briefly breached the $120 mark before

Via MarketMinute · March 9, 2026

American Airlines receives downgrade. Surging oil, jet fuel prices from Iran and Middle East conflicts create 'existential threat' for airlines.

Via Investor's Business Daily · March 9, 2026

The war is a one-two punch for airlines, and their stocks are plummeting.

Via The Motley Fool · March 8, 2026

Shares are trading at 50% off their highs, but that may not be enough.

Via The Motley Fool · March 7, 2026

The global travel sector faced a harsh reality check on March 6, 2026, as a sudden and aggressive spike in crude oil prices sent shockwaves through the equity markets. Southwest Airlines (NYSE: LUV) saw its shares tumble by 5.7%, while Norwegian Cruise Line Holdings (NYSE: NCLH) suffered an even

Via MarketMinute · March 6, 2026

American Airlines Group shares are dropping due to rising jet fuel prices and a customer base that is more sensitive to fare increases.

Via Benzinga · March 6, 2026

The global aviation sector is facing its most significant crisis since the post-pandemic recovery, as a "perfect storm" of surging jet fuel prices and escalating geopolitical instability in the Middle East threatens to derail industry profitability. Over the past week, the "Big Three" U.S. carriers have seen their valuations

Via MarketMinute · March 6, 2026

NEW YORK — The U.S. economy has officially entered a "worst-case scenario" as of March 6, 2026, with the specter of stagflation—a paralyzing combination of stagnant growth and high inflation—sending shockwaves through global markets. This morning’s Department of Labor report revealed a stunning contraction in the workforce,

Via MarketMinute · March 6, 2026

March 6, 2026 — Global financial markets are reeling as gold futures successfully breached the unprecedented $5,300 per troy ounce milestone this week, cementing the precious metal's status as the ultimate hedge in an era of systemic instability. The rally, which saw spot prices peak as high as $5,594

Via MarketMinute · March 6, 2026

Via Benzinga · March 6, 2026

In a week that has sent shockwaves through the American economy, retail gasoline prices have surged by a staggering 9%, the sharpest weekly increase in nearly four years. As of March 5, 2026, the national average for a gallon of regular unleaded has hit $3.25, up from just $2.

Via MarketMinute · March 5, 2026

On March 5, 2026, Wall Street weighed jet fuel risks and fresh Venezuela routes in reassessing this airline.

Via The Motley Fool · March 5, 2026