NVIDIA Corp (NVDA)

191.13

-1.38 (-0.72%)

NASDAQ · Last Trade: Jan 30th, 9:23 PM EST

Detailed Quote

| Previous Close | 192.51 |

|---|---|

| Open | 191.21 |

| Bid | 190.21 |

| Ask | 190.25 |

| Day's Range | 189.47 - 194.49 |

| 52 Week Range | 86.62 - 212.19 |

| Volume | 179,490,683 |

| Market Cap | 4.64T |

| PE Ratio (TTM) | 47.31 |

| EPS (TTM) | 4.0 |

| Dividend & Yield | 0.0400 (0.02%) |

| 1 Month Average Volume | 162,524,581 |

Chart

About NVIDIA Corp (NVDA)

NVIDIA Corporation is a leading technology company primarily known for its innovations in graphics processing units (GPUs) that enhance visual computing across various applications, including gaming, professional visualization, and artificial intelligence. Beyond its strong presence in gaming, NVIDIA's products are integral to deep learning and data center solutions, empowering advancements in machine learning, autonomous vehicles, and high-performance computing. By leveraging its cutting-edge technologies, NVIDIA aims to drive the future of computing and improve experiences across industries, from entertainment to scientific research. Read More

News & Press Releases

The booming artificial intelligence (AI) infrastructure business has been a fantastic investment.

Via The Motley Fool · January 30, 2026

After a volatile start to 2026, these three dividend stocks combine strong early momentum, analyst support, and income potential for the year ahead.

Via Barchart.com · January 30, 2026

Reports surfaced this week that Amazon.com, Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI, the world’s leading artificial intelligence laboratory. This potential deal, first reported by major financial outlets on January 29, 2026, marks a seismic shift in the "AI Arms

Via MarketMinute · January 30, 2026

In a week that many analysts are calling a "watershed moment" for the future of transportation and artificial intelligence, Tesla (NASDAQ:TSLA) reported fourth-quarter 2025 earnings that defied the grim expectations of the "EV winter." On January 28, 2026, the company posted a non-GAAP earnings per share (EPS) of $0.

Via MarketMinute · January 30, 2026

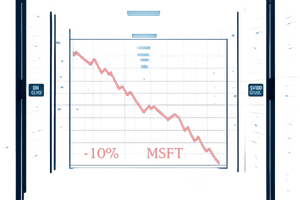

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

MENLO PARK, CA — In a resounding validation of its aggressive pivot toward artificial intelligence, Meta Platforms (NASDAQ:META) saw its stock price skyrocket by 9% in late January 2026. The surge followed a blowout fourth-quarter earnings report that silenced critics of the company’s massive capital expenditure and established the

Via MarketMinute · January 30, 2026

Apple Inc. (NASDAQ: AAPL) delivered a commanding performance in its fiscal first-quarter earnings report on January 29, 2026, shattering revenue and profit records on the back of explosive demand for the iPhone 17. Despite exceeding analyst expectations across nearly every major metric, the tech giant saw its stock price decline

Via MarketMinute · January 30, 2026

In a move that sent immediate shockwaves through global financial markets, President Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on the morning of January 30, 2026, represents a fundamental shift in the leadership

Via MarketMinute · January 30, 2026

Nvidia's stock still has a lot of potential upside.

Via The Motley Fool · January 30, 2026

Intel is back in focus as Apple reportedly looks to use its U.S. foundries, sparking fresh debate over whether INTC stock is worth buying now.

Via Barchart.com · January 30, 2026

OpenAI and Anthropic are expected to have IPOs in 2026, potentially driving up AI infrastructure spending and benefiting companies like Nvidia, Amazon, and Microsoft.

Via Benzinga · January 30, 2026

This artificial intelligence (AI) stock has beaten the heavyweights over the past year and still trades at a very attractive valuation.

Via The Motley Fool · January 30, 2026

Even assuming MI450 arrives on time, AMD stock simply costs too much.

Via The Motley Fool · January 30, 2026

The Conference Board’s Leading Economic Index (LEI) recorded a 0.3% slip in its latest reading, signaling a cooling trajectory for the United States economy as it enters the new year. This downturn, reported in January 2026, marks a pivotal moment for markets that have been grappling with the

Via MarketMinute · January 30, 2026

Baseten is carving out a high-growth niche in the AI market.

Via The Motley Fool · January 30, 2026

SEATTLE — In a move that has sent tremors through Silicon Valley and Wall Street, reports surfaced today, January 30, 2026, that Amazon.com Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI. This unprecedented capital injection, if finalized, would mark the largest single investment

Via MarketMinute · January 30, 2026

In a pivotal moment for the electric vehicle pioneer, Tesla, Inc. (NASDAQ: TSLA) reported fourth-quarter 2025 earnings that defied pessimistic forecasts, triggering a relief rally across the technology and automotive sectors. Despite posting its first annual revenue contraction in company history, Tesla delivered a significant beat on adjusted earnings per

Via MarketMinute · January 30, 2026

In a high-stakes moment for the technology sector, Apple (NASDAQ: AAPL) delivered a resounding rebuke to skeptics on January 29, 2026, reporting record-breaking results for its holiday quarter. While the company’s stock has spent much of the past year acting as a significant weight on the S&P 500

Via MarketMinute · January 30, 2026

Broadcom is one of the best AI data center stocks to buy right now.

Via The Motley Fool · January 30, 2026

In a move that signals a seismic shift in American monetary policy, President Donald Trump has officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on January 30, 2026, marks the beginning of the end for the

Via MarketMinute · January 30, 2026

As of January 30, 2026, the global semiconductor landscape has reached a pivotal inflection point, with China officially declaring 2026 the "first year" of large-scale glass substrate production. This strategic move marks a decisive shift away from traditional organic resin substrates, which have dominated the industry for decades but are now struggling to support the [...]

Via TokenRing AI · January 30, 2026

Sandisk stock soars on a blockbuster Q2 release, but a Cantor Fitzgerald analyst says SNDK shares aren’t out of juice just yet.

Via Barchart.com · January 30, 2026

As the global demand for artificial intelligence continues to spiral, the industry has hit a formidable roadblock: the "energy wall." With massive Large Language Models (LLMs) consuming megawatts of power and pushing data center grids to their breaking point, the race for a more sustainable computing architecture has moved from the fringes of research to [...]

Via TokenRing AI · January 30, 2026

As of January 30, 2026, the United States' ambitious effort to repatriate semiconductor manufacturing has officially transitioned from a period of legislative hype and groundbreaking ceremonies to a reality of high-volume manufacturing (HVM). With over $30 billion in federal awards from the CHIPS and Science Act now flowing into the ecosystem, the "Silicon Desert" of [...]

Via TokenRing AI · January 30, 2026

As of January 2026, the artificial intelligence landscape has transitioned from a period of desperate hardware scarcity to an era of fierce architectural competition. While NVIDIA Corporation (NASDAQ: NVDA) maintained a near-monopoly on high-end AI training for years, the narrative has shifted in the enterprise data center. The arrival of the Advanced Micro Devices, Inc. [...]

Via TokenRing AI · January 30, 2026