Freeport-McMoRan (FCX)

60.41

+1.56 (2.65%)

NYSE · Last Trade: Jan 23rd, 6:28 PM EST

Exploring the top movers within the S&P500 index during today's session.chartmill.com

Via Chartmill · January 23, 2026

As the first month of 2026 unfolds, a dramatic shift in market leadership is reshaping investor portfolios. For years, the dominant narrative was the unstoppable ascent of mega-cap technology, but by January 23, 2026, that story has encountered a significant rewrite. Investors are aggressively rotating out of high-flying AI and

Via MarketMinute · January 23, 2026

Which S&P500 stocks are moving before the opening bell on Friday?chartmill.com

Via Chartmill · January 23, 2026

Freeport-McMoRan Inc (NYSE:FCX) Reports Strong Q4 2025 Earnings Beat, Muted Market Reactionchartmill.com

Via Chartmill · January 22, 2026

Freeport-McMoRan (FCX) Q4 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026

Major U.S. equity markets surged on Wednesday after President Donald Trump announced a pivotal shift in his administration's Arctic strategy, backing away from a proposed "Greenland Tax" that had threatened to ignite a trade war with European allies. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite

Via MarketMinute · January 22, 2026

On January 22, 2026, Freeport-McMoRan (NYSE: FCX) reported fourth-quarter 2025 financial results that topped Wall Street estimates on both the top and bottom lines. Despite delivering a significant earnings beat fueled by record-high metal prices, shares of the Phoenix-based mining giant tumbled in early trading, eventually closing down nearly 2%

Via MarketMinute · January 22, 2026

In a historic geopolitical shift that aims to redraw the map of the global energy transition, the United States and the Democratic Republic of Congo (DRC) have finalized the "Washington Accords." This strategic mineral pact, cemented in early 2026, represents a bold maneuver by the U.S. to secure a

Via MarketMinute · January 22, 2026

DAVOS, Switzerland — In a move that has sent shockwaves of relief through global financial markets, President Donald Trump used his keynote address at the World Economic Forum in Davos on January 21, 2026, to announce a "framework deal" for the strategic integration of Greenland into a joint U.S.-NATO

Via MarketMinute · January 22, 2026

Date: January 22, 2026 Introduction As the world’s appetite for electricity reaches a fever pitch, one company stands at the epicenter of the global energy transition: Freeport-McMoRan (NYSE: FCX). On this day, January 22, 2026, the Phoenix-based mining giant finds itself in a paradoxical position. While copper prices have shattered historical records—trading above $6.00 per [...]

Via Finterra · January 22, 2026

Cosmic rays from supernovas will help secure the supply of crucial minerals.

Via The Motley Fool · January 22, 2026

As the global financial markets navigate the opening weeks of 2026, a massive structural shift has taken hold of the commodities sector. Industrial and precious metals are currently undergoing a historic price surge, with gold, silver, and copper all testing psychological and technical ceilings that were once thought unreachable. This

Via MarketMinute · January 20, 2026

As the third week of January 2026 draws to a close, the financial landscape is witnessing a profound structural shift that many analysts are calling "The Great Realignment." After two years of nearly unrivaled dominance by Silicon Valley’s elite, the momentum that once fueled the high-flying Technology sector has

Via MarketMinute · January 20, 2026

Chamath Palihapitiya, also known as the SPAC King, just revealed his top investment idea for 2026.

Via The Motley Fool · January 20, 2026

As of January 20, 2026, a historic transformation is sweeping through the U.S. stock market, marking the most significant reallocation of capital since the post-pandemic recovery. Investors are aggressively rotating out of the high-flying, mega-cap technology stocks that dominated the last decade and into the "unloved" sectors of the

Via MarketMinute · January 20, 2026

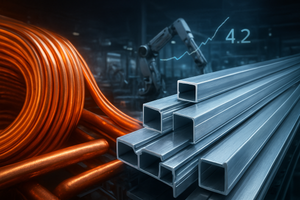

The global commodities market has reached a historic inflection point as of January 2026, with industrial manufacturers aggressively pivoting from copper to aluminum. This shift is no longer a matter of marginal cost-saving; it has become a structural necessity as the copper-to-aluminum price ratio has surged past 4.2, a

Via MarketMinute · January 20, 2026

The global commodities market reached a historic milestone this month as copper prices on the London Metal Exchange (LME) surged past the unprecedented $13,000 per tonne mark. Driven by a combination of acute supply-side fragility and a sudden escalation of geopolitical tensions in South America, the red metal has

Via MarketMinute · January 20, 2026

In a definitive shift that has sent ripples through global commodity markets, a landmark report released on January 18, 2026, by the Green Finance & Development Center (GFDC) and Griffith University has unveiled a massive resurgence in China’s Belt and Road Initiative (BRI). Beijing has committed a record-breaking $213.5

Via MarketMinute · January 19, 2026

Learn how probabilistic options trading helps professionals manage risk and improve consistency in uncertain markets.

Via InvestorPlace · January 17, 2026

Via MarketBeat · January 16, 2026

As of mid-January 2026, the global commodities market is witnessing a seismic shift as the Middle East transitions from a fossil-fuel giant to a critical minerals powerhouse. Recent data released at the 2026 Future Minerals Forum in Riyadh indicates that copper demand across the region is projected to surge by

Via MarketMinute · January 16, 2026

The global push for electrification and the surging energy demands of artificial intelligence have placed copper at the center of the modern industrial map. Standing at the forefront of this movement is Freeport-McMoRan (NYSE: FCX), the world’s largest publicly traded copper miner. As of January 16, 2026, the company finds itself navigating a "copper crunch" [...]

Via Finterra · January 16, 2026

In a week that financial historians may long remember as the "Great Commodities Re-Rating," the prices of gold, silver, and copper surged to unprecedented highs on January 14, 2026. Driven by a volatile cocktail of institutional crises in the United States, escalating military tensions in the Middle East, and a

Via MarketMinute · January 16, 2026

ANN ARBOR, MI — On January 15, 2026, the global automotive industry finds itself at a crossroads that many experts warn is paved with a metal the world simply does not have. As copper prices hover near record highs of $13,000 per metric ton following a volatile 2025 "super-squeeze," a

Via MarketMinute · January 15, 2026

As of mid-January 2026, the global commodities market is grappling with a stark reality that researchers warned of years ago: the world is running out of the "red metal" just as it needs it most. Copper prices, which famously breached the $11,000 per tonne mark in a chaotic 2024

Via MarketMinute · January 15, 2026