Slam Corp. - Class A Ordinary Share (SLAM)

11.14

+0.00 (0.00%)

NASDAQ · Last Trade: Dec 15th, 6:00 PM EST

Detailed Quote

| Previous Close | 11.14 |

|---|---|

| Open | - |

| Bid | 10.99 |

| Ask | 17.76 |

| Day's Range | N/A - N/A |

| 52 Week Range | N/A - N/A |

| Volume | 0 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | - |

Chart

About Slam Corp. - Class A Ordinary Share (SLAM)

Slam Corp is a special purpose acquisition company (SPAC) that is focused on identifying and merging with high-growth companies, particularly within the sports and entertainment sectors. The firm seeks to leverage its management team's industry expertise and network to create value and drive growth for the businesses it partners with. By providing access to public capital markets, Slam Corp aims to facilitate the expansion and development of innovative enterprises that align with its strategic vision, ultimately benefiting both investors and stakeholders in the competitive landscape of sports and entertainment. Read More

News & Press Releases

SLAM Corp. (NASDAQ: SLAM), a special purpose acquisition company (“Slam” or the “Company”), today announced that the Company, as anticipated, received a notice from The Nasdaq Stock Market LLC (“Nasdaq” or the “Exchange”), stating that in accordance with Nasdaq rules, Slam’s securities will be delisted from the Exchange. At the open of trading on Tuesday, August 27, 2024, Slam’s securities will be suspended on Nasdaq and are expected to begin trading on the OTC Markets under the tickers “SLAM” and “SLAMW”, respectively, ensuring uninterrupted market activity for its shareholders.

By Slam Corp. · Via Business Wire · August 26, 2024

BALA CYNWYD, Pa., Feb. 05, 2024 (GLOBE NEWSWIRE) -- Brodsky & Smith reminds investors of the following investigations. If you own shares and wish to discuss the investigation, contact Jason Brodsky (jbrodsky@brodskysmith.com) or Marc Ackerman (mackerman@brodskysmith.com) at 855-576-4847. There is no cost or financial obligation to you.

By Brodsky & Smith LLC · Via GlobeNewswire · February 5, 2024

Lynk Global, Inc. (“Lynk”), the world’s leading satellite-direct-to-standard-phone (“sat2phone”) telecoms provider, and Slam Corp. (NASDAQ: SLAM), a special purpose acquisition company (“Slam”), today announced that they have entered into a definitive business combination agreement (the “Business Combination Agreement”) under which Slam will combine with Lynk. Upon completion, the combined company will operate as Lynk Global Holdings, Inc. and its common stock is expected to be publicly listed on Nasdaq under the ticker symbol “LYNK”.

By Lynk Global, Inc. · Via Business Wire · February 5, 2024

Alex Rodriguez has invested in real estate and sports companies over the years. A SPAC will help Rodriguez invest in the satellite and space sectors.

Via Benzinga · December 18, 2023

Lynk Global, Inc. (“Lynk”), the world’s leading satellite-direct-to-standard-phone (“sat2phone”) telecoms provider, and Slam Corp. (NASDAQ: SLAM), a special purpose acquisition company (“Slam”), today announced that they have signed a non-binding letter of intent (“LOI”) for a potential business combination. Under the terms of the LOI, the combined company (the "Combined Company") would operate as Lynk Global, Inc. and its common stock and warrants are expected to be listed on Nasdaq under the ticker symbol “LYNK” and “LYNKW,” respectively.

By Lynk Global, Inc. · Via Business Wire · December 18, 2023

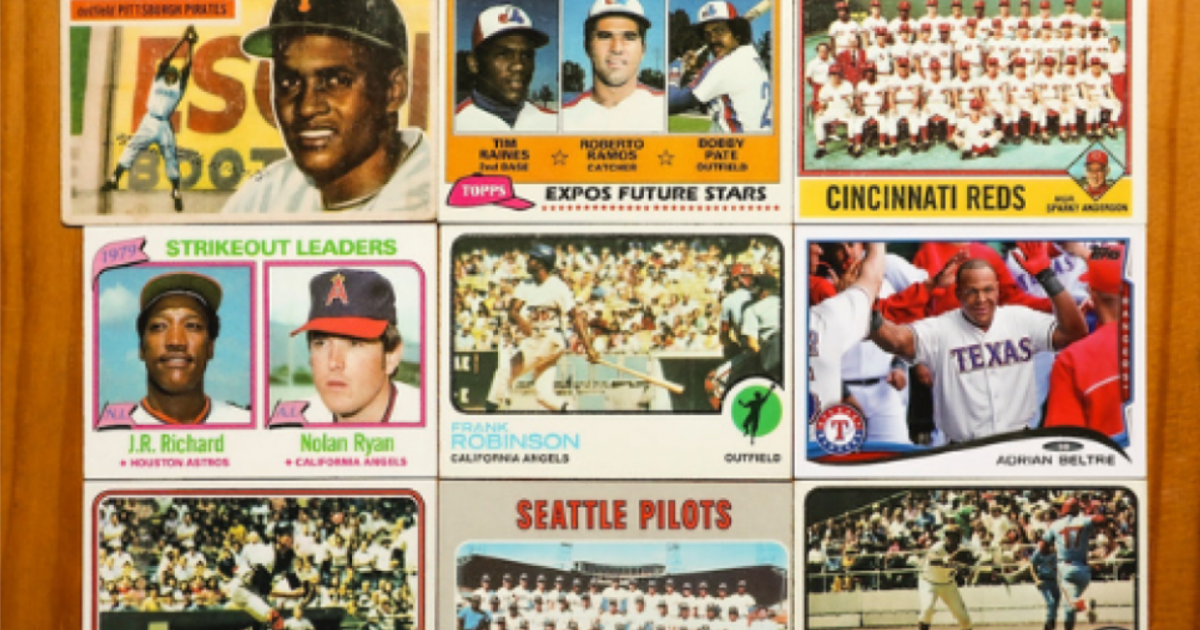

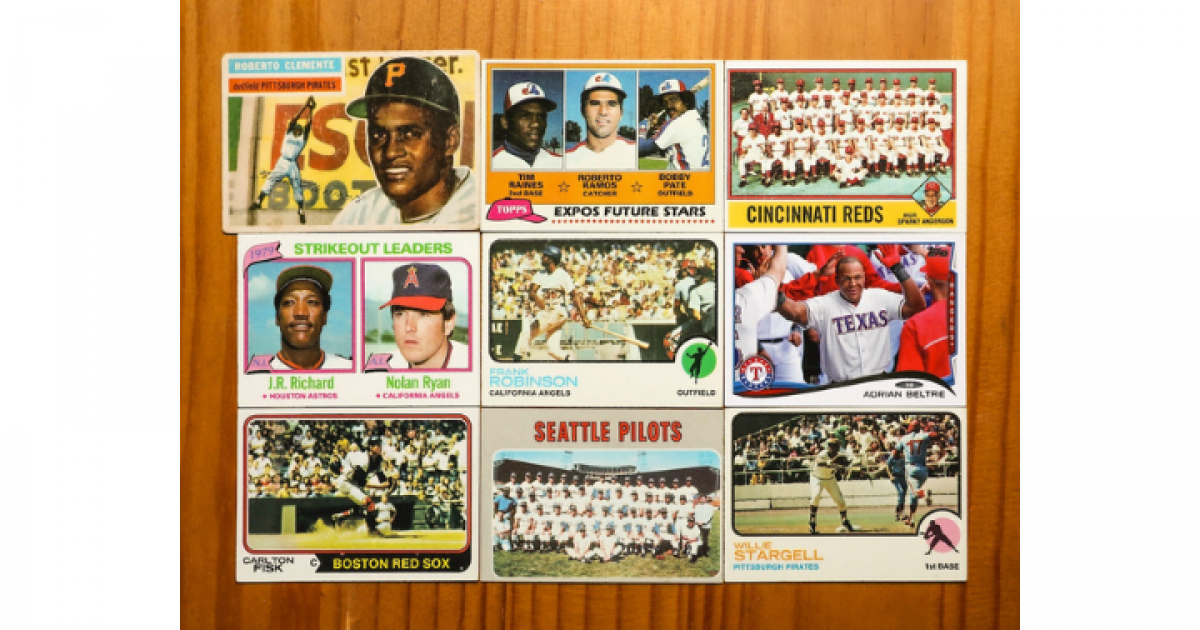

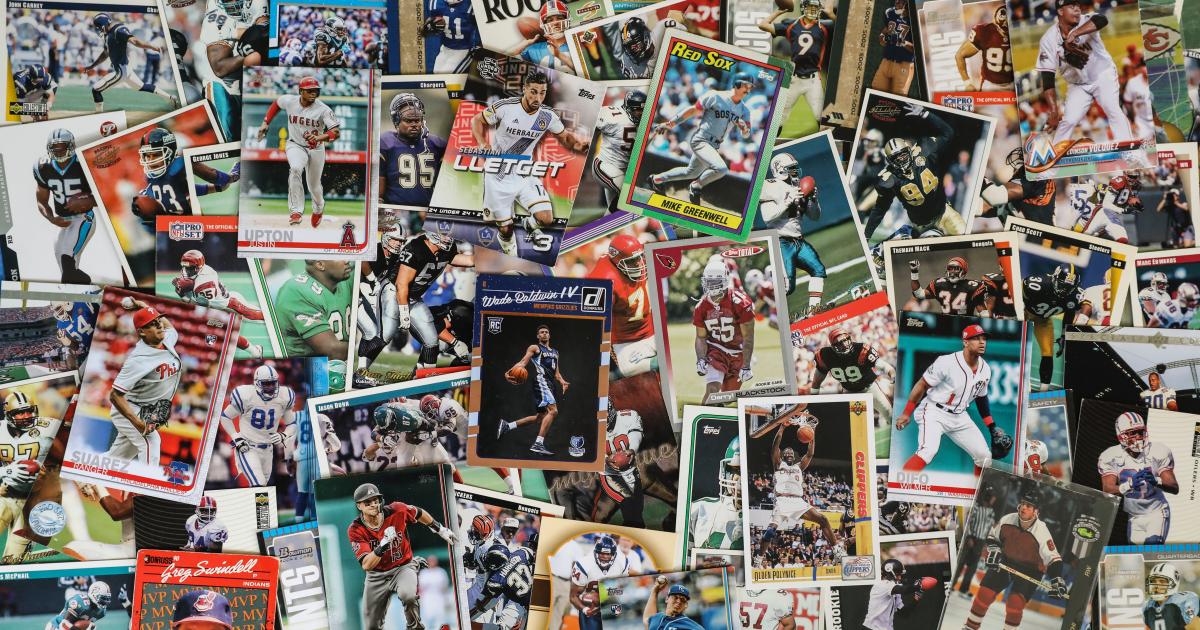

A new trading card giant is taking shape with an acquisition of one of the most well-known brands in the space. The acquisition comes from a company that became their biggest...

Via Benzinga · January 4, 2022

Ownership of sports teams has often been limited to the wealthy or family members who inherited the team. A handful of sports teams are publicly traded, offering investors the...

Via Benzinga · December 3, 2021

Thanks to Donald Trump's new deal, mergers are hot again. Here are our picks for seven of the best SPACs to watch as the new boom takes off.

Via InvestorPlace · November 11, 2021

One of the most talked about SPAC deals in the sports world has been terminated and will not go through as originally agreed upon.

What Happened: Topps, the iconic trading card...

Via Benzinga · August 20, 2021

A trading card company in talks to go public via SPAC is the latest to capitalize on the name, image and likeness deal that sees college athletes able to monetize...

Via Benzinga · July 22, 2021

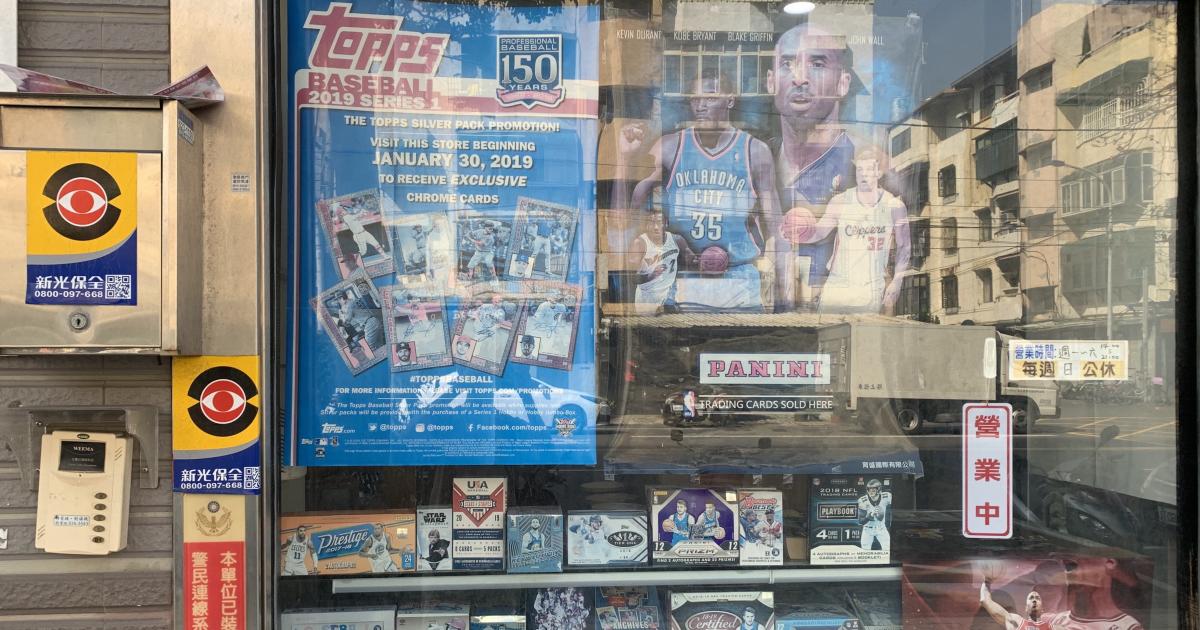

In SPAC news this week, Aurora has agreed to go public via merger with a Reinvent SPAC, while A-Rod's Slam SPAC is said to be in merger talks with Italy's Panini Group.

Via Talk Markets · July 18, 2021

If you collect trading cards or World Cup stickers, chances are you’ve heard of the 60-year-old Italian company Panini. Rival Topps announced a SPAC deal earlier this...

Via Benzinga · July 15, 2021